EUR/USD

The Euro hit resistance just above1.3820 during Friday and drifted weaker during the New York session with lows near 1.3720. There was a slight moderation in oil prices which curbed US selling pressure and the Euro was vulnerable to a limited correction after failing to break technical levels.

As far as the US economic data is concerned, there was an unexpected downward revision to 2.8% from 3.3% for the fourth-quarter GDP estimate. In contrast, the University of Michigan consumer confidence index was revised higher to a 77.5 for February from 75.1 and this was the highest reading since early 2008. The fact that confidence appears to be holding firm in the face of rising energy costs could be an important positive economic signal, although there may simply be a delay before any negative impact is registered.

The provisional Irish election results were broadly in line with opinion-poll readings with the governing Fianna Fail party registering heavy losses and a Fine Gael-led government will take office. There will be further speculation that the new government will take a more aggressive line on Irish debt obligations and underlying stresses surrounding the Euro-zone will also persist.

The ECB will be a very important focus this week with the council meeting due on Thursday. Markets will be expecting a tough tone on inflation from the bank and there will be some speculation that the bank will effectively signal a near-term rate increase which will tend to underpin the Euro ahead of the meeting. The Euro found support on dips to near 1.3710 against the dollar on Monday and rallied to 1.3760 on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break back above 82 against the yen during Friday and weakened to lows near 81.60 during the US session with the dollar unable to gain much support even though risk appetite was slightly stronger as equity markets attempted to rally.

Concerns over stresses within oil-rich countries will continue to provide some defensive support for the Japanese currency with a reluctance to take an aggressive stance towards carry trades, especially with increased uncertainty over the growth outlook.

Domestically, there was a 2.4% industrial production increase for February which was weaker than expected while the retail sales data also remained subdued with a 0.1% annual increase.

Sterling

Sterling was blocked just above 1.6150 against the dollar ahead of the UK economic releases on Friday. The fourth-quarter GDP estimate was revised down to show a 0.6% quarterly decline from -0.5% previously which had a negative impact on sentiment. There were also weak readings for business investment and services-sector activity which reinforced unease over the economy.

There was a weather-related impact for the fourth quarter and there will be a corrective bounce for the current three months, but underlying confidence will remain fragile.

The latest PMI surveys will be extremely important for sentiment this week, especially as the Bank of England will be watching the survey evidence very closely when it takes its interest-rate decision the following week.

The UK currency retreated to lows below 1.6040 against the dollar, but recovered back to above 1.61 on Monday, gaining some support from a stabilisation in global risk appetite.

Swiss franc

The dollar found support below 0.9250 against the franc on Friday and briefly pushed to a high above 0.9310, but it was unable to sustain the gains and weakened back to the 0.9260 area in Asia on Friday. The Euro also found it difficult to gain ground even though risk appetite stabilised. The franc will gain fresh support if there is any intensification of tensions within the Middle East.

The latest KOF business confidence index registered at 2.18 for February from a revised 2.16 for January and the high reading suggests that companies as a whole are managing to cope with the very strong exchange rate. There will, therefore, be some easing of pressure for immediate action by the National Bank to weaken the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

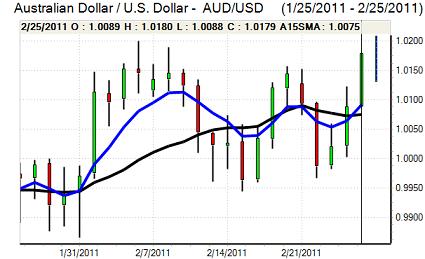

Australian dollar

The Australian dollar found support just below 1.01 against the US currency on Friday and pushed to a high near 1.0170 with the currency continuing to find support on dips during Asian trading on Monday.

Trends in risk appetite will remain important and, although the Australian currency may gain some support if tensions ease, the underlying risk premium is liable to remain higher which will curb strong Australian dollar demand, especially with reduced confidence in the regional growth outlook.

The domestic data was slightly disappointing with a significant decline in corporate profits and there will be strong expectations that the Reserve Bank will leave interest rates on hold this week.