Ben Franklin once said “If you would persuade, appeal to interest and not to reason.”

While this quote is often referenced in relation to negotiations, it can apply to an individual’s desire to purchase a stock as well.

BUYERS AND SELLERS

A stock’s price pattern is essentially a constant interplay between buyers and sellers, negotiating over the value of ownership in a company. The common interest for buyers is the pursuit of a profit, or for the seller, preservation of capital. A unique phenomena occurs when an idea becomes popular, creating a contagious desire to buy or sell a stock.

TRENDS

This phenomenon creates trends in stocks, or even entire markets. While market participants’ reasons for buying or selling may vary greatly, their interests remain closely aligned: profit versus capital preservation. Therefore, it is often helpful for investors to review the degree of participation in a trend to see if a large number of stocks support the trend. When reviewing a market, an advance-decline line provides investors with a tool that helps measure the amount of participation in a trend, or lack thereof.

WATCH THE A/D LINE

The Advance-Decline line can provide additional insight if they are broken into Large, Mid, and Small Cap segments as well. Mid and Small Cap issues often comprise over 80% of the issues traded on a major stock market exchange, yet are commonly overlooked due to a focus on large cap stocks and capitalization weighted market indexes.

Traditionally, at market tops, a negative divergence between the total market advance-decline line and the major price index can warn investors of internal deterioration in a market. A review of the Segmented Advance Decline lines at major market tops shows a pattern of deterioration typically occurring in the Small and Mid cap Advance Decline lines prior to the deterioration in the Large Cap Advance-Decline lines.

SMALL AND MID CAP OFFER FIRST CLUES

Therefore, as a market uptrend matures, Small and Mid Cap issues will often display the first signs of internal market deterioration, which can eventually evolve into a market decline. Investment managers can use this information to help steer their portfolios away from weakening market segments, and allocate capital to the strongest market segments.

Additionally, as the Mid and Small cap advance-decline lines begin to deteriorate, it generally signifies a period of increasing market risks as fewer stocks are participating in the market’s uptrend, and portfolios should be adjusted accordingly.

EUROPEAN STOCKS

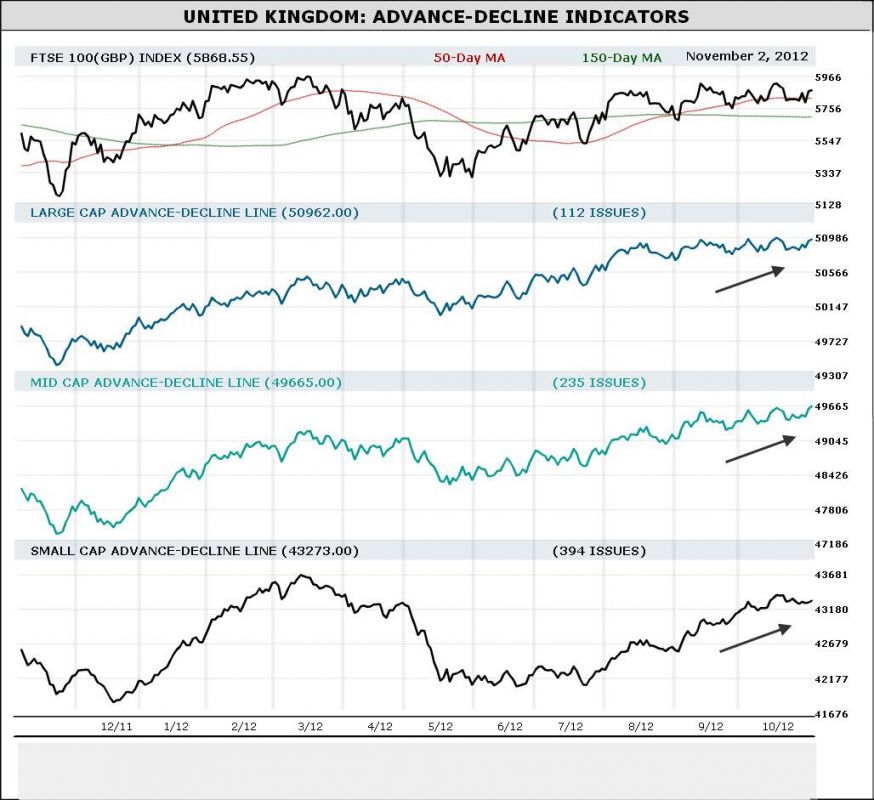

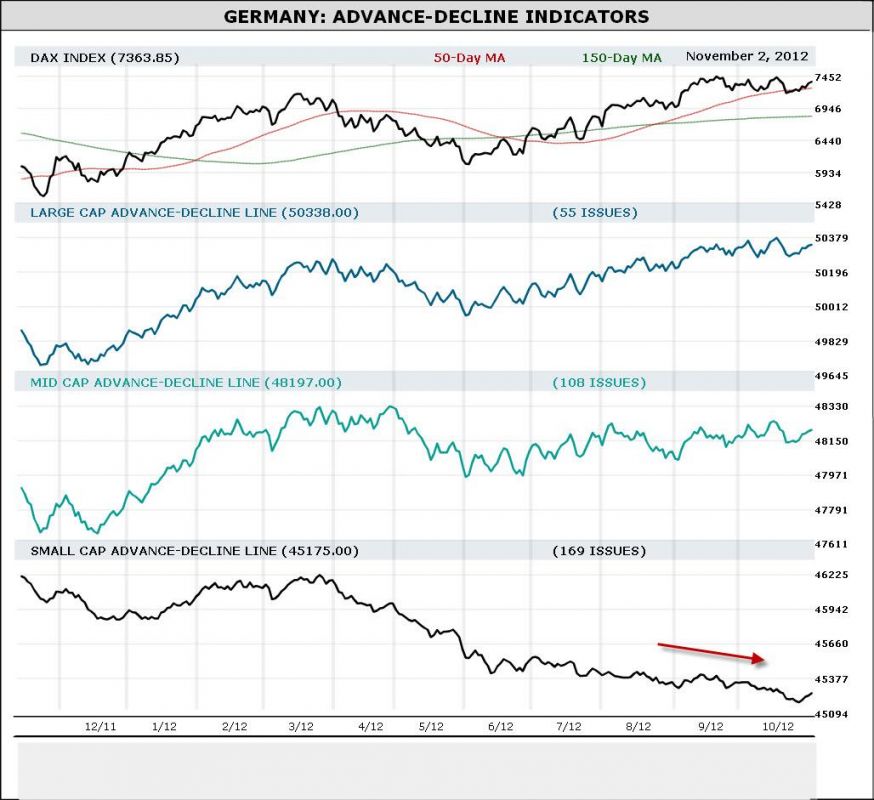

When reviewing the current market advances in many European countries, many continue to display ongoing deterioration in their small cap advance-decline lines. Surprisingly, the United Kingdom’s advance decline lines continue to reflect ongoing strength. Below are two charts displaying the Segmented Advance-Decline lines for the United Kingdom (Fig. 1) and Germany (Fig. 2).

UK ACTION

Currently, the United Kingdom’s Advance-Decline lines continue to move higher across all three market segments, suggesting broad based participation supporting the markets’ move higher. This strength in all three A-D lines is supportive of an ongoing healthy uptrend. Conversely, the A-D line for the German market shows a persistent lag in the small cap A-D line while the mid cap A-D line lags slightly.

Additionally, many of the countries in the Europe, including several Nordic countries, continue to show deterioration in their Small and Mid Cap A-D lines, warning of thinning participation in their uptrends.

For example, in Germany, the ongoing weak trend in the small cap A-D line suggests that portfolio managers should steer their portfolios towards large cap issues. Also, investors should closely monitor Germany’s Mid and Large Cap Advance-Decline lines for accelerating deterioration in the months ahead, which would warn of a potential market decline.

Therefore, it appears that the United Kingdom’s market may outperform in the weeks ahead as its market is showing strong participation in the recent rally while Germany’s market advance appears to be displaying thinning participation. While the two previous examples are focused on Europe, the value of the Segmented Advance-Decline lines extends to all markets around the world, giving investors valuable insight into where and how much participation is behind the market’s price action.

= = =

Read our daily Markets section here for specific trading ideas.