Everyone hates a ‘V’ bottom because it rarely gives a chance to get on board and messes with a trader’s mind. Once again, we have another rally that is hated by everyone. This one was a whopper – 220 SPX points in just three short weeks, an historic move in such a short time period. Most didn’t get in before the turn and a slew of others thought the end of the bull rally was nigh and leaned to the bearish side too heavily.

That proved fatal in mid October unless you had the courage to say you were wrong. But once the rubber band was stretched far back enough and then snapped, the market started to rise – where/when were you going to get in if you were on the sidelines? So many had said this: ‘I will wait for a 10% correction and then get in’. We went down about 9.4% over a month – that seemed just about right, didn’t it?

Oh, and don’t get me started about the media frenzy. As the market was taking a nosedive last month the chatter was there was no end in sight, 5% down would lead to 10% down, then 20% and a bear market. Fear mongering is great for ratings – after all, isn’t a market that goes up just boring? Who needs to be smart about that? I’ve said for years, ignore the noise and distractions that take you off your game. Some thought the Sept 19 BABA release was the market top, yet the market didn’t tell us this was to be the case.

Now, could we have predicted this size of rally off the levels below? Heck no! Anyone who says so is lying their butt off. I thought we were overbought 100 handles ago, but my thought is meaningless to the markets. Trade what you see, not what you think. This was a move of monumental proportions that had just about everyone flummoxed. However, the conditions were ripe. As a momentum trader, trying to find bottoms or tops is not my game, I leave that for the market timers to fight over. That’s a fun game to play, but you’ll lose money at it.

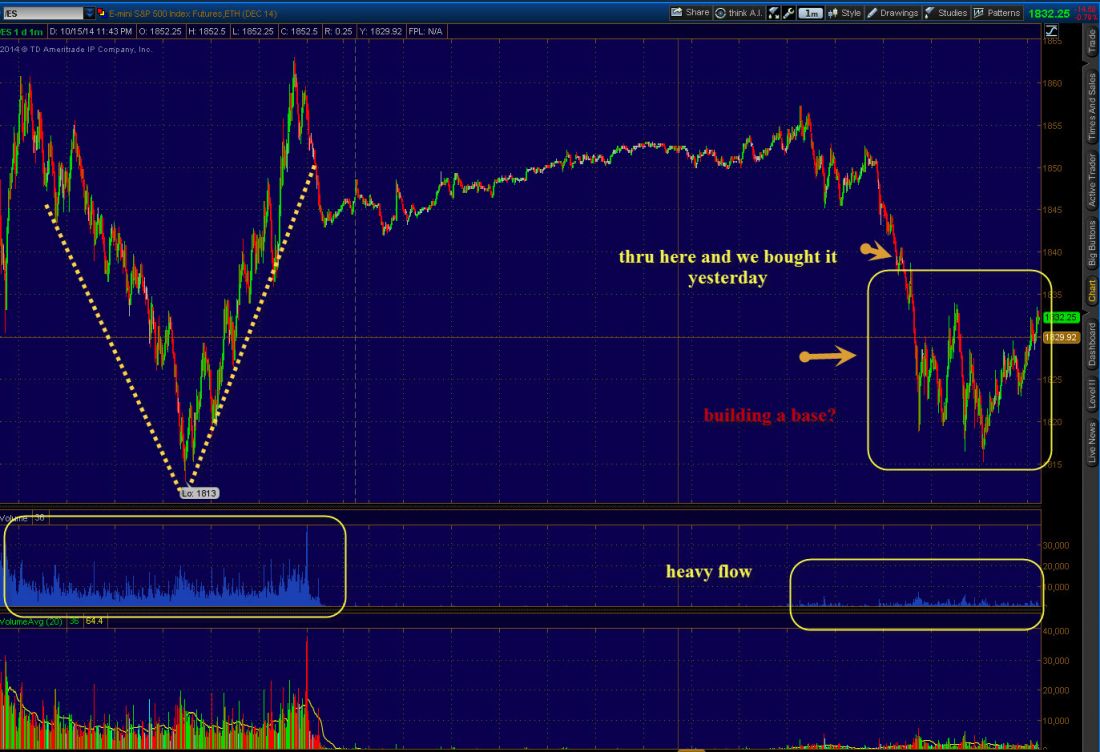

But, I am not naive enough to not recognize a lopsided condition, those moments are rare indeed. At that point you trust your judgment, pull the trigger and let it fly. Unless something disastrous were to occur the odds were pretty good the market would snap back sharply. See the futures chart below that identified a buy point after the bottom was in.

Here we stand with this V shaped rally. Many think they are late to the party and are frustrated for missing a more than 10% rally. My advice? Listen to the message of the markets, proceed with caution and go with what is working. If it is ‘up’, then go with it. Protect yourself, be aware and bank profits when you have them. Easier said than done, but not impossible if you are focused and prepared.

Bob Lang is a private trader in equity and option markets at his company, Aztec Capital LLC, and an options trader mentor through his education-focused subscription service,Explosive Options. He is the author of popular, strategy-focusedebooks on options trading, one of Jim Cramer’s go-to technical experts on Mad Money and a regular contributor toTheStreet.com. You can find him on Twitter@aztecs99.