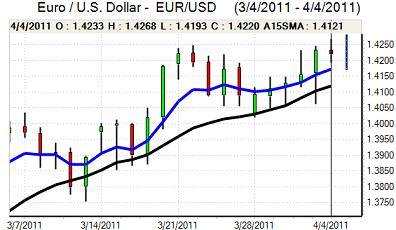

EUR/USD

The Euro hit resistance close to 1.4250 against the dollar during Monday and edged weaker during the session, but trading ranges were narrow as markets took stock following recent events and continued to focus on prospective monetary policies. Existing yield spreads remained unhelpful for the dollar which certainly stifled buying support and limited recoveries.

In comments on Tuesday, Fed Chairman Bernanke stated that inflation would be pushed higher by rises in commodity and energy prices. The comments were relatively brief, but Bernanke did say that the inflation rise should be transitory. These remarks will dampen market expectations that the Fed will push towards a more aggressive policy in the near term. The latest FOMC minutes will be watched closely on Tuesday for evidence of splits within the Fed committee.

The latest European data recorded a decline in the Sentix investor confidence index to 14.2 for March from 17.1 the previous month and there will be further fears that rising energy prices will undermine business confidence and dampen growth.

For now, there is no sign that the ECB is pulling away from its planned increase in interest rates at this week’s meeting. There will still be fears that rising energy prices will intensify inflation pressures and this poses a very important dilemma for the ECB given that growth doubts will also increase. Overall, the bank is likely to be cautious and it should refrain from making definitive comments over future policy.

The Euro drifted lower in Asian trading with a move to just below 1.42, but ranges remained narrow.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to below 83.90 against the yen during Monday and maintained a generally robust tone with a move back above 84 during the Asian session on Tuesday.

There was no further increase in US Treasury yields as Bernanke maintained a generally dovish tone, but the US currency still gained important support. There was further increase in using the yen as a funding currency as carry-trade activity remained high.

Underlying confidence in the Japanese fundamentals remains weak with further expectations that the bank will be forced to monetize government debt issues which could lead to substantial medium-term yen depreciation. The Japanese currency will gain some defensive support if fears that high energy prices will derail the economy increase. The dollar pushed to a high above 84.50 in Asian trading on Tuesday.

Sterling

Sterling hit resistance close to 1.6170 against the US dollar during Monday and weakened to test support near 1.61 in generally cautious trading. The Euro tested support below 0.88 against the UK currency before finding support.

As far as economic data is concerned, the PMI construction index edged slightly lower to 56.4 from 56.5 the previous month, but this was better than expected. The latest data showed that home owners continued to repay debt during the fourth quarter while the Chambers of Commerce survey showed that confidence remained fragile.

The PMI services data will be watched very closely on Tuesday and a combination of subdued activity, together with rising inflation would increase policy difficulties for the Bank of England while a strong outcome would make it difficult for the bank to resist higher rates. Trading activity is likely to be subdued ahead of Thursday’s central bank interest rate decision, especially as there will be some speculation over an increase in rates.

Swiss franc

The dollar dipped to test support near 0.92 against the franc during US trading on Monday before finding support and rallying back to the 0.9240 area as the dollar secured some wider respite. The Euro was unable to break above 1.32 against the Swiss currency and dipped back towards the 1.31 area.

Global risk conditions will remain extremely important in the near term and the franc will tend to lose ground when confidence in the global economy increases. The position is finely balanced as defensive demand is liable to increase again if markets fear that high energy costs will trigger a renewed downturn.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar was unable to make a fresh attack on 1.04 against the US dollar during Monday and there was a generally softer tone, but it did find support above the 1.03 level.

The latest trade data was much weaker than expected with a monthly deficit of AUD0.21bn for February compared with expectations of a substantial surplus and this was the first deficit for 10 months. The PMI services index remained below the pivotal 50 level which will maintain doubts over growth trends.

In contrast, there were no surprises from the Reserve Bank of Australia as it left interest rates on hold at 4.75%. The statement was broadly similar to the previous meeting with the central bank comfortable with the current stance.