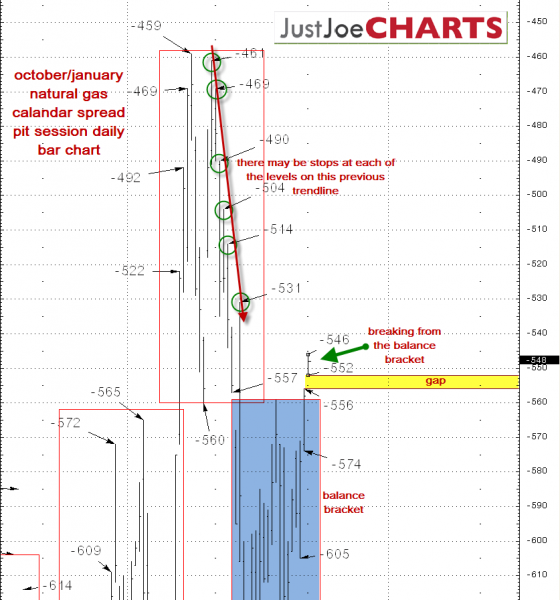

Traders in the energy complex need to be on alert this morning as a potential development is in the works. Taking a look at the Oct/Jan natural gas calendar spread–stops along a previous trendline may cause a “firecracker effect.”

When you light the fuse of a pack of firecrackers, the fuse reaches the first firecracker and it pops. The explosion of the first firecracker triggers the explosion of the second firecracker and so on causing a pop, pop, pop sound. We could see this unfold along points on a trendline in this spread.

BREAKING FROM BALANCE

The Oct/Jan spread has been contained within a -559 to -648 balance bracket for the last three weeks. During the Monday holiday electronic session, the spread gapped open higher above the balance bracket and left a -552 to -546 gap.

TWO SCENARIOS

When a market breaks above or below a balance bracket, there are two possible scenarios to look for:

o Acceptance outside the balance bracket and acceleration.

o Rejection outside the balance bracket and a rotation back to the opposite end of that balance bracket begins.

FIRECRACKER EFFECT

Firecracker effect is a term I learned from taking several of Jim Dalton’s trading seminars. There is a previous trendline from July that starts at -531 and goes to -461, with several points along that trendline.

STOP ALERT

There is a possibility that there are stops at all of the points along that trendline.

QUICK MOVE POSSIBLE

If the market reaches that -531 level, it may trigger stops, which in turn may move the market to the next point on the trendline, triggering the next set of stops and so on. Triggering the stops along that previous trendline could move the market through that trendline range rather quickly.

[Editor’s note: to learn more about Jim Dalton’s trading approach and market profile analysis, please see the front page features section story here.]