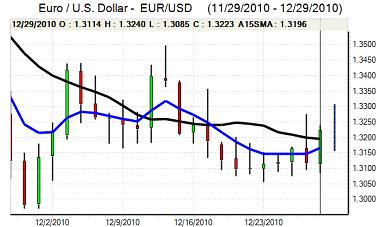

EUR/USD

The Euro found continued support below 1.31 against the dollar during Wednesday, underpinned in part by the persistent ability to hold above the 200-day moving average and advanced firmly later in the US session with the strong tone sustained in Asia on Thursday.

There was a decline in US Treasury yields which curbed demand for the US currency and there was also general optimism over the global economy. This combination boosted demand for high-yield instruments and also encouraged increased carry trades funded through the US currency.

The Euro-zone economic data did not have a substantial impact but will tend to offer some degree of Euro support. There was firmer growth in money supply and bank lending which suggests a slight underlying improvement in credit supply. The latest German inflation data was also stronger than expected and a 1.9% annual increase will cause some unease within the ECB.

Market liquidity remained very low and the Euro pushed to a high just above 1.3250 against the dollar before consolidating.

The Euro was still hampered by underlying stresses and fears that conditions will deteriorate further during the first quarter of 2011. The main Irish opposition party threatened to hold a no-confidence vote if a date for fresh elections is not announced soon and there will certainly be fears that bond-market tensions will return very quickly once the new year starts.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to regain the 82.50 level against the yen in European trading on Wednesday and then fell sharply with a low of 81.25. This was a fresh 7-week low for the dollar and also represented the eight successive daily decline.

The dollar was undermined by a decline in US bond yields and there was further evidence of year-end capital repatriation flows which underpinned the Japanese currency.

There will be demand to hold the yen into the last trading session of 2010 given the strong performance seen during the year, but there is the potential for some reassessment at the start of 2011, especially as global growth optimism will tend to curb defensive yen demand. Markets will also be on high alert over the potential for Bank of Japan intervention to reverse currency gains, especially as poor liquidity would magnify the impact.

Sterling

Sterling found support close to 1.5350 against the dollar on Wednesday and advanced strongly to a high above 1.5520 late in the US session. The UK currency gained support primarily from a weaker dollar as Sterling remained weaker than 0.85 against the Euro.

There was some evidence of corporate year-end demand for Sterling with some increase in fund weightings, although low liquidity is also likely to have been a key component.

Overall confidence in the UK economy remains weak and is liable to deteriorate further. The latest Bank of England data continued to register a net repayment of equity into the housing sector and this will tend to be a drag on consumer spending. There will also be expectations that higher taxes will undermine spending at the start of 2011 and weak growth conditions would make it more difficult for the Bank of England to tighten monetary policy.

Swiss franc

The dollar was unable to move above 0.9520 against the franc on Wednesday and was then subjected to renewed selling pressure late in the US session with the US currency hitting a fresh record low below 0.9425 in Asian trading on Thursday. The Euro remained firmly on the defensive against the Swiss currency and was trapped below 1.25 despite a recovery against the dollar.

There will be further year-end demand for the franc in the very short term, but these flows will soon subside which will tend to curb franc buying. There will still be underlying defensive inflows into the franc on fears that Euro-zone tensions will intensify again early in 2011. Domestically, the KOF business confidence index held above 2.00 for December which will also help underpin franc confidence.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

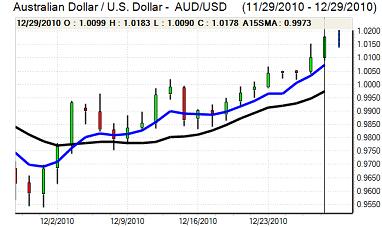

Australian dollar

The Australian dollar resisted profit taking on Wednesday and advanced further in New York on Wednesday with a high close to 1.02 as it reached a fresh 28-year peak against the US currency.

Commodity prices remained strong which boosted maintained demand for the Australian dollar as optimism over the global growth outlook persisted.

There was some retracement following a weaker reading for the December Chinese manufacturing PMI reading, but there was still solid buying support on dips.