“Tools are designed to make jobs easier and workers more productive. The ultimate goal is to make the job more profitable. Some tools are better than others… “

—Greg Michalowski, Attacking Currency Trends. (A book well worth reading and a good friend of mine.)

So, who bought the euro last week? No, I don’t mean for a scalp, I mean because it was “a great price” or “it was on a strong level” or “because this candle pattern looks like a trend reversal.”

Those were all really bad ideas and not just in retrospect. They were pretty lousy ideas at the time.

PRICE IS NOT A REASON TO BUY A CURRENCY

Let’s start with the first. I hear a lot of traders talking about the price of this or that and how it’s a great level to buy.

For a stock, where you may have some objective measure of value or at least a comparative measure of value in an industry, maybe that’s a good argument. But we all know I’m not talking about stocks.

Price should NEVER be a reason for buying a currency. It should almost never be a reason for buying a commodity. It should maybe sometimes, if there are other supporting reasons, be a reason for buying a stock.

PRICE LEVELS

On to levels. Price usually stops on significant prior levels. But, if it doesn’t stop on this level, it might stop on the next level, or the next level…. Or… well, hopefully you get the idea. Levels are the first thing to look at when determining the possibility of a trend change. They are a lousy indicator all by themselves.

In a downtrend, it’s more prudent to wait for a bounce off of a level than it is to buy on said level. If you don’t have the patience for that, or if you just don’t need the money, you can overnight a cashier’s check to my office.

TREND REVERSAL

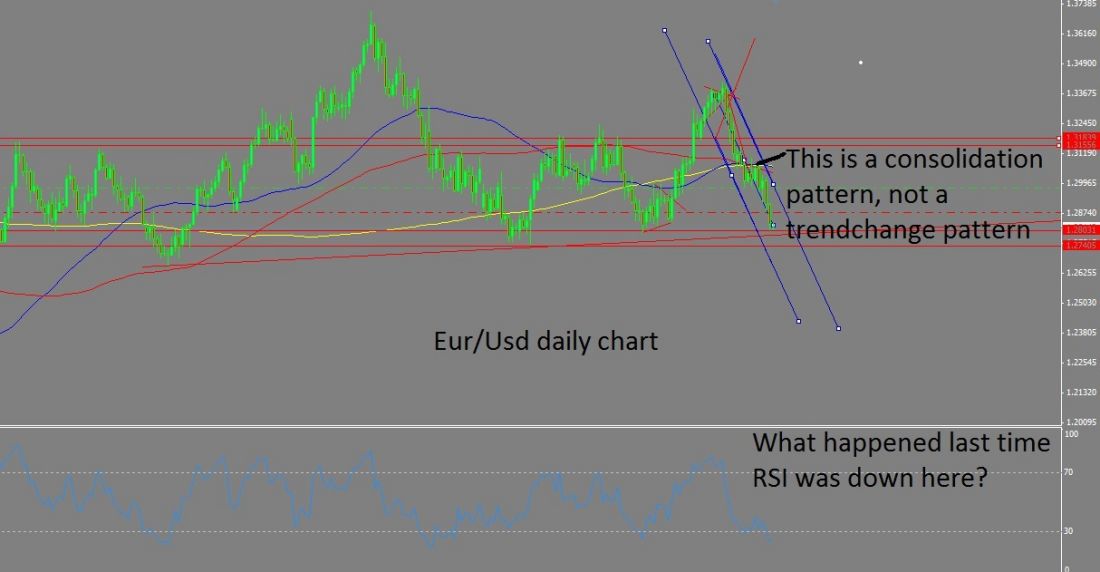

Ok, last but not least: “That price action looks like a trend reversal.” Well, last week, no it didn’t. I’ll show you what one looks like later. That price looked like a consolidation. Yeah, sure you can scalp or day trade a few pips to the long side (I did) but is that a great way to make money?

Not really.

In last week’s case, price consolidated below the 50, 100 AND 200 day moving average, and never made any headway above any of those. We flopped between a few fib lines, but didn’t have any convincing movements to the north.

WAIT FOR CONFIRMATION

When trading, it’s prudent to wait for some meaningful confirmation before getting into the market. When price is moving in a direction, consolidations and pullbacks are healthy. These should be seen as times to enter the prior trend, not times to reverse course.

Trading forex is tricky, but remember the trend is your friend and you should generally defer to the prior dominant trend in the event of a consolidation.

CURRENT MARKET ACTION

That being said, we are sitting on some pretty strong daily support. It’s probably time to be careful. RSI is reaching oversold and we haven’t had much of a pullback in this fall yet. It’s important to have a set of guidelines, but it’s more important to be on the right side of the market. I would be careful buying a 600 pip selloff without a lot of wiggle room.

On the other hand, I would be very careful selling after price has already come 600 pips. This is a relatively light week on the economic front. I would favor consolidations or pullbacks over trending moves assuming non scheduled news stays out of the way.