Mixed statistical releases are preventing the Canadian dollar from assembling up a rally against the U.S. dollar.

MIXED DATA

Over the past couple weeks, we have seen foreign buying of Canadian securities reach a seven-month high. That has occurred while manufacturing sales have fallen four of the last five months and while Canadian debt continues to grow. Meanwhile, the job market saw its best gains since May 2002.

CHOPPY TRADE

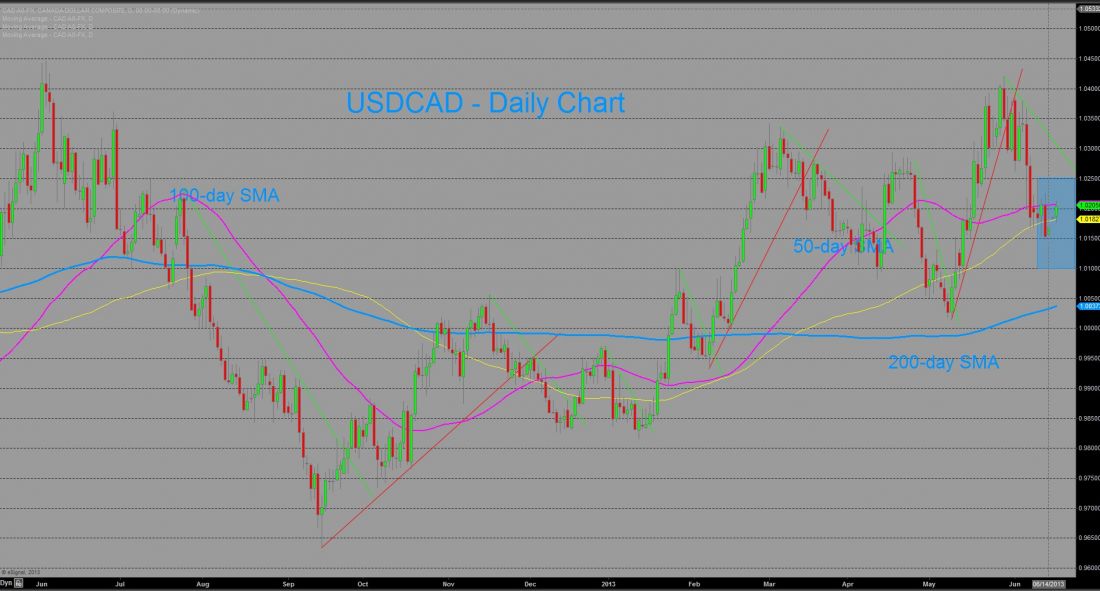

It should come as no surprise that price action on the daily chart for dollar/Canada (USD/CAD) has been trading between in a very choppy downtrend that is often respecting the 50 and 100 day simple moving averages.

WAITING ON THE FED

The recent Canadian dollar weakness has come from concerns that the Fed may reduce bond purchases.

At the conclusion of the two-day Fed meeting we anticipate price falling/breaking outside of the 1.01 – 1.0250 range. Today’s U.S. data points did not support the taper idea. We anticipate the Fed to ease up on the rhetoric of the potential reduction of stimulus and emphasize that they will not be tightening anytime soon.

The end result may be further loonie strength.

= = =

Learn more about Moya’s work here.