I too hope in this short reign to be a man of peace.

Pope Benedict XVI

As I was reading through this morning’s headlines, the only thing that caught my attention is news of Pope Benedict XVI’s resignation. This is the first such event since Pope Gregory XII in 1415. Other than that, the forex calendar is pretty light this week. So I thought I’d lead with something of historical note, but not really trading related. (I could be wrong, but I doubt this news will move the market).

RISK ON

On the trading side, we are still very much in a risk on environment. While it’s always prudent to watch for deeper corrections, it’s also prudent to follow the dominant trend. So far as this concerns trading, the euro has been respecting this uptrend and the support and resistance lines we’ve been talking about for several weeks.

EURO/DOLLAR

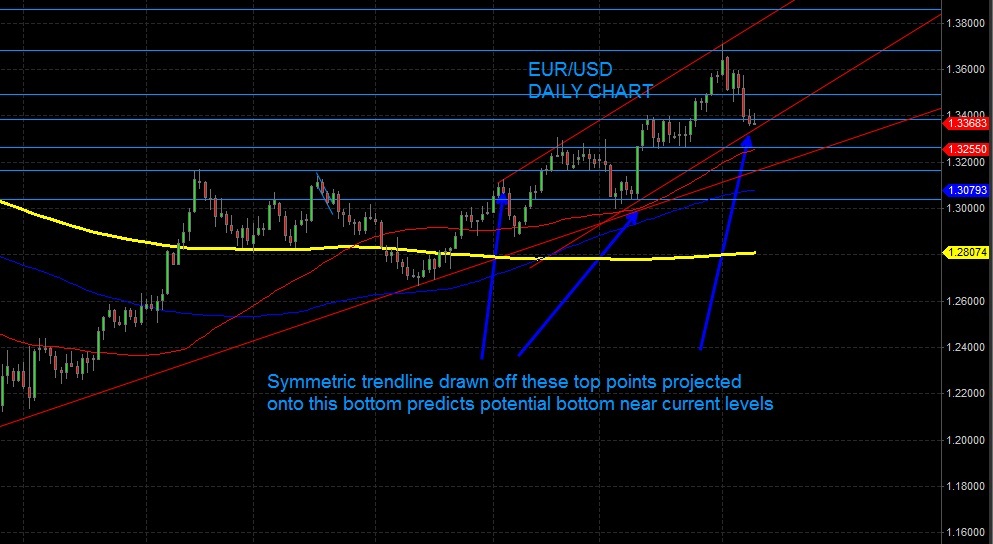

Today, we look again at the daily euro/dollar chart. While the most recent five-day downtrend (more easily seen on a smaller timeframe) shouldn’t be ignored, so long as equities and other risk currency pairs remain bullish, this move should be seen as a consolidation. I’m sure there’s some news from Europe which sparked this decline, but ask yourself if that news is new or something you’ve heard for a while. In other words: new fears about debt in some country somewhere isn’t really news so far as the market is concerned. News strong enough to change this trend move must be at least perceived as noteworthy and new information.

BUY SPOT

That being said, I would be comfortable looking to buy the euro around current levels. We are sitting on daily support. When the upper trendline on the graph is copied and projected onto the bottom (or my second arrow) it hits again close to price at the current levels. In addition, price at this level is right at the 50% retracement of the swing move from 1/4/13 to recent highs on 2/1/13 (not illustrated on my picture). Now of course we don’t know if this level will hold until it does or doesn’t, but we have a reasonable expectation that this area is supportive. So, if one was to buy near current levels, we have a defined risk and a reasonable expectation of price moving up at least to our next resistance level if not potentially retesting the highs or even new highs.

FOLLOW THE PLAN

On the other hand, if this play is wrong, we will have come up with a decent trade idea, defined our risk well, and simply been wrong. But that’s ok. Trading isn’t about being right or wrong, it’s about making money. Money is made in the plan, execution and follow up. Not in being right.

= = =

Read more trading ideas in our daily Markets section.