The Canadian dollar is a commodity currency that soon may also have the title of reserve currency. If classified a reserve currency, the loonie, its nickname may continue to strengthen, as governments and institutions choose to diversify away from the U.S. currency.

Some countries like Russia have already started to hold Canadian dollars and according to Russian Ambassador to Canada, Georgiy Mamedov, next year they will double their reserves to 1.6%.

WARNING SIGNS

Two red flag may prevent further Canadian dollar strength.

The first is if oil prices remain stable or eventually correct lower once the tensions in the Middle East ease.

The second is if investors become weary of Canada’s deficit reduction agenda. Harper’s conservative government spending projections are being scrutinized and may lower the expectation of balancing the budget within the next five years. Even with this deficit issue, Canada is still the envy all of its European and U.S. trading partners.

KEY LEVELS

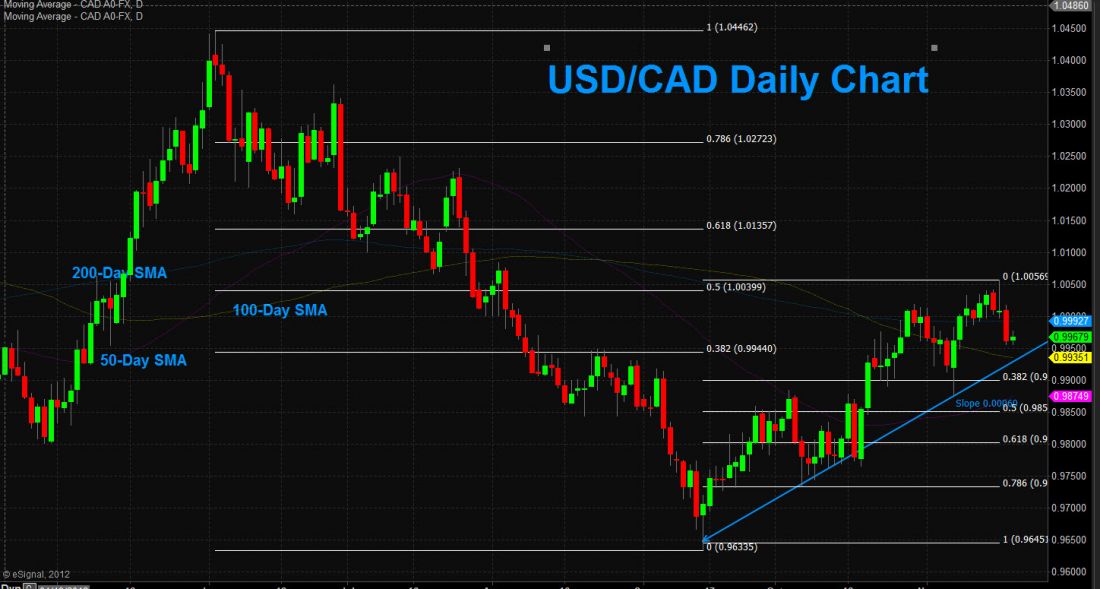

If bearish price action breaks below both the .9941 level and the short-term bullish trend line, price could move towards .9860, which is also the 50.0% Fibonacci retracement of the bullish move. Critical resistance will lie at 1.0010.

= = =