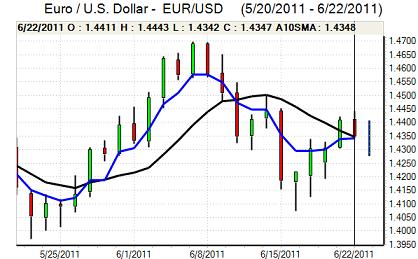

EUR/USD

The Euro found support close to 1.4350 against the dollar during Wednesday and again tested resistance above 1.44 ahead of the Federal Reserve policy meeting.

There were no surprises from the FOMC meeting with interest rates left on hold at 0.00 – 0.25% range. There was a downgrading of growth forecasts with the forecast expansion for 2011 cut to a 2.7 – 2.9% range from 3.1 – 3.3% previously. The Fed expressed some concerns over price increases, but it expected that inflation was expected to fall to or below the level consistent with full employment and inflation in the medium term. The Federal Reserve stated that interest rates would be held at low levels for an extended period and the inflation comments suggested that further quantitative easing could still be considered in the medium term.

Fed Chairman Bernanke declined to make any direct references to further quantitative easing and the main message was that there was a high degree of uncertainty over the situation. The dollar gained some support on relief that there was no mention of further quantitative easing.

There were further discussions surrounding the Greek debt crisis as political negotiations continued. The government will hold a parliamentary vote on reform measures next week and the EU will decide on the next aid package on July 3rd. There will be fears that the government could lose the vote, especially as the opposition party stated that it would refuse to back fresh austerity. There will also still be strong expectations that Greece will default in the medium term.

There was a general deterioration in risk appetite following the Fed’s statement which triggered some defensive demand, although the US currency was still struggling to gain any momentum.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to 80 against the yen during Wednesday and gained ground following the US FOMC meeting with a move to the 80.55 area. There was a small increase in yields after the Fed meeting which provided some dollar support, although yields are unlikely to trigger strong US buying.

There was evidence of robust buying support close to the 80 level and there will be further institutional US buying which will provide important support for the dollar, especially with caution over the potential for intervention if markets become disorderly.

The latest Chinese PMI manufacturing index retreated to 50.1 for June from 51.6 previously which will maintain expectations of a sharp slowdown in the Chinese economy and provide some defensive yen support on expectations of a wider slowdown.

Sterling

Sterling was unable to sustain a move above 1.6250 against the dollar on Wednesday and edged lower in early European trading before retreating sharply following the June Bank of England minutes release.

There was no surprise on the interest rate vote split with a 7-2 decision to hold rates at 0.50%. The bank was generally gloomy over the economic outlook, warning that the weakness in demand was liable to last longer than expected. There were also references that several members considered the possibility of further quantitative easing if downside risks to the medium-term outlook materialised.

The minutes reinforced expectations that interest rates would remain at extremely low levels and there were also further fears surrounding the banking sector which sapped Sterling support.

With increased caution towards the global economy, the UK currency weakened to 11-week lows near 1.60 against the dollar and also tested support near 0.8950 against the Euro.

Swiss franc

The dollar remained on the defensive against the franc during European trading on Wednesday and dipped to lows below 0.8350 before finding support and regaining the 0.84 level. The Euro was unable to make any impression as it drifted back towards the 1.20 level.

The Swiss franc continued to gain defensive support from a lack of confidence in the Euro, especially as there were still strong expectations that Greece would eventually default.

There was a decline in the Swiss ZEW business confidence index to -24.3 for June from -11.5 the previous month which triggered some concerns that the strong franc is starting to have a more damaging impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

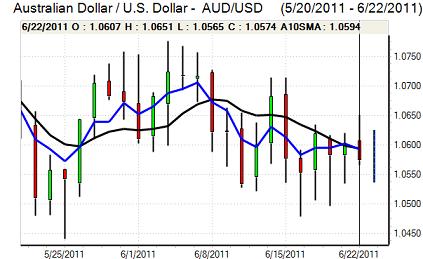

Australian dollar

There was a renewed increase in Australian dollar volatility over the past 24 hours as the currency initially rallied from the 1.0560 area to a peak near 1.0650 before weakening sharply again from late in the US session with a dip to below 1.0550 in Asia on Thursday.

The US currency rallied from initial weakness which undermined the Australian dollar and there was a sharp decline in commodity prices following a downgrading of the Fed’s growth forecasts. The weaker than expected reading for the flash Chinese PMI index also undermined confidence in Asian growth prospects which undermined the Australian currency, especially as there was speculation that the Chinese central bank would raise interest rates again, possibly within the next few days.