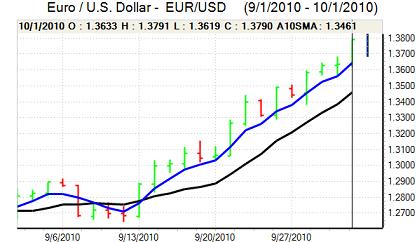

EUR/USD

The Euro held steady in early Europe on Friday and maintained a robust tone during the day as demand for the dollar remained weak.

The Euro-zone economic data was slightly weaker than expected with unemployment at 10.1% for August while there was a second successive decline in German retail sales. There was some relief that there was no further negative news surrounding the Irish banking sector or the wider Euro-zone financial sector which helped underpin the Euro.

The US ISM manufacturing index was close to expectations with a decline to 54.4 for September from 56.3 the previous month. The sub-components were generally weak and there will be further expectations of an underlying slowdown in the economy.

There were significant comments from Fed officials during the day. Regional Fed President Evans stated that further policy easing was desirable, although he is not an FOMC voting member this year. More importantly, Fed Governor Dudley also made dovish comments describing the current economic performance as unacceptable and stating that further policy action was needed. The comments will reinforce speculation that the Federal Reserve will embark on further quantitative easing at the November meeting.

In this environment, the dollar remained under pressure and weakened to a six-month low near 1.3800 against the Euro as sentiment surrounding the US currency remained extremely weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese economic data was close to expectations, but with a slightly stronger than expected tone as household spending rose 1.7% in the year and unemployment fell to 5.1% from 5.2%. The rate of consumer price falls also declined slightly with a 1.0% annual fall, but deflation fears will remain a consistent background issue.

Prime Minister Kan stated that the authorities may intervene further and also called on the Bank of Japan to take further action to support the economy. Markets will remain very wary over the threat of intervention, but the dollar was trapped close to 83.50 during Asian trading on Friday.

The US currency dipped further to test support near 83.10, but markets were unwilling to push the US currency even weaker given fears that the Bank of Japan was very close to intervening again.

Sterling

Sterling found support close to 1.57 against the dollar in early Europe on Friday and strengthened sharply to highs above 1.5850 as the US currency was subjected to renewed selling pressure.

The UK economic data provided no support for Sterling with a decline in the manufacturing PMI index to 53.4 for September from a revised 53.7. This was the lowest figure for 10 months and there will be particular unease over a decline in export orders.

The data will reinforce expectations that the Bank of England could move to further quantitative easing within the next few months. In this environment, there will be nervousness over Sterling ahead of the forthcoming MPC policy meeting. The services-PMI data will also be closely watched closely on Tuesday.

Sterling hit resistance above 1.5850 against the dollar and edged back towards 1.58 with the UK currency also at a fresh 4-month low near 0.87 against the Euro.

Swiss franc

The dollar found support below 0.9750 against the franc on Friday, but was unable to push above the 0.9820 area as wider weakness undermined the US currency. The Euro maintained a firm tone and tested resistance above 1.3450 against the franc.

There was a decline in defensive demand for the Swiss currency as immediate fears surrounding the Euro-zone declined with no further bad news surrounding the Irish banking sector. Underling confidence is still liable to prove fragile and could reverse quickly.

There was a slowdown in Swiss retail sales growth to 0.9% from a revised 4.7% the previous month. The PMI index registered a slowdown for September, although it was still at an historically high level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

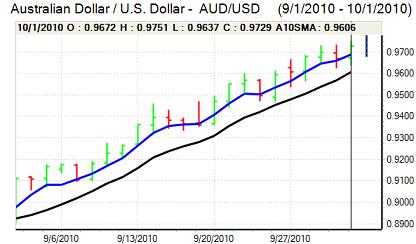

Australian dollar

The Australian dollar continued to take advantage of a weaker US currency during Friday and there was also a limited boost from the firmer than expected Chinese PMI index. The currency strengthened to fresh 2-year highs near 0.9750 against the US dollar, but did underperform on the crosses.

The domestic economic data was weaker than expected with a decline in the manufacturing PMI index to below the 50 level for the first time in 9 months. The recent weakness in domestic data will trigger some doubts as to whether the Reserve Bank of Australia will decide on a further increase in interest rates at the forthcoming meeting on Tuesday.