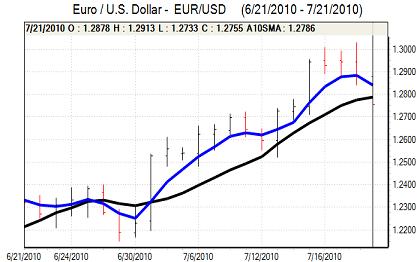

EUR/USD

The Euro was unable to make any headway in early Europe on Wednesday and drifted weaker in cautious trading. There was no economic data to guide markets during the day

Within the Euro-zone, there was further uncertainty over the bank stress tests due on Friday and there were increased doubts whether the tests would be robust enough to reassure investors. There was also a disappointing Portuguese bond auction with weakening demand for securities. The Euro is still being held back by structural vulnerabilities with fears that growth will not be strong enough to alleviate the underlying pressures.

Fed Chairman Bernanke was generally cautious with comments that economic outlook was unusually uncertain. He stated that financial conditions were less favourable for growth, but there was some optimism that loan losses had peaked while there were comments that the economy was moving ahead moderately. Bernanke also stated that it was evaluating various methods to shrink the balance sheet.

There was some relief that the Fed did not announce a cut in interest rates payable on excess reserves, but Bernanke did outline potential additional support measures if they were required and this reinforced a lack of yield support for the dollar.

Risk appetite deteriorated significantly following the testimony as investors fretted over the global growth outlook and the Euro weakened to test lows below 1.2750 as Wall Street came under pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There were a lack of fresh trading incentives on Wednesday with cautious remarks on the economy by the government having a small negative impact on the yen, although the official Cabinet Office assessment was left unchanged in the July report.

There was also some support for the Australian dollar which curbed demand for the yen. The dollar held above the 87 level against the Japanese currency, but found it difficult to make much headway.

The US currency pushed to a high around 87.50 on cautious bidding, but was unable to sustain the gains. The US currency came under renewed selling pressure following Bernanke’s comments, but there was support close to 87 with a reluctance to push the yen stronger.

Sterling

Sterling spiked lower in early Europe on Wednesday with a decline to below 1.52 with reports that the plunge was due to an electronic trading error.

The MPC minutes recorded a 7-1 vote for unchanged interest rates at the July meeting with Sentance voting for an increase for the second successive meeting. The minutes revealed that there were discussions to consider both a modest tightening and loosening of conditions. The bank is uneasy over the inflation outlook, but is also expecting growth to be weaker than expected.

The net impact is likely to be to dampen expectations of significant interest rate increases and this also dampened demand for Sterling. Uncertainty will remain a key risk given the potential for divisions within the MPC.

There was a renewed decline to test support close to 1.5150 against the dollar following Bernanke’s testimony. Sterling was also unable to sustain gains beyond the 0.84 level against the Euro.

Swiss franc

The dollar found support close to 1.0480 against the franc on Wednesday, but was unable to make much headway and faced further resistance close to 1.0550. The dollar moves were cushioned by franc trends on the crosses with the Euro generally fragile as it registered a sharp decline to near 1.34.

Uncertainty over the European bank stress tests was significant in providing further defensive demand for the Swiss currency and caution is likely to prevail in the short term.

The National Bank recorded losses of CHF14.1bn for the first half of 2010 which reinforced market speculation that the central bank would not be in a position to intervene.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

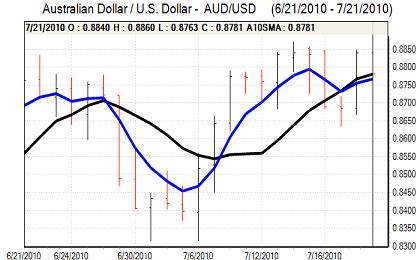

Australian dollar

The Australian dollarmaintained a firm tone in Asian trading on Wednesday with a test of resistance close to the 0.8850 area. There was some speculation over a domestic interest rate increase which provided support while risk appetite was generally firmer which also provided some backing.

There are still very important domestic and international risks and the Australian currency retreated back to below 0.88 during the US session as equity markets came under renewed selling pressure following Bernanke’s testimony.