Over the last week or so the Nasdaq futures have been busy filling gaps. This is a type of technical housekeeping that organizes corrections and gives them clear targets. Up-gaps represent irrational exuberance and that emotion is always tested/corrected. Down-gaps represent panic and that emotion is likewise almost always re-evaluated in the cold light of another day.

As noted on Monday, the gap police had two remaining fugitives to capture at 4419 and 4349. The first one was filled on Tuesday and the second one on Wednesday. These are not the only unfilled gaps in the Nasdaq futures, (there are several more from the October 2014 rally), but they are the most obvious targets for this correction. So let’s assume the gap hunt process is over for the time being.

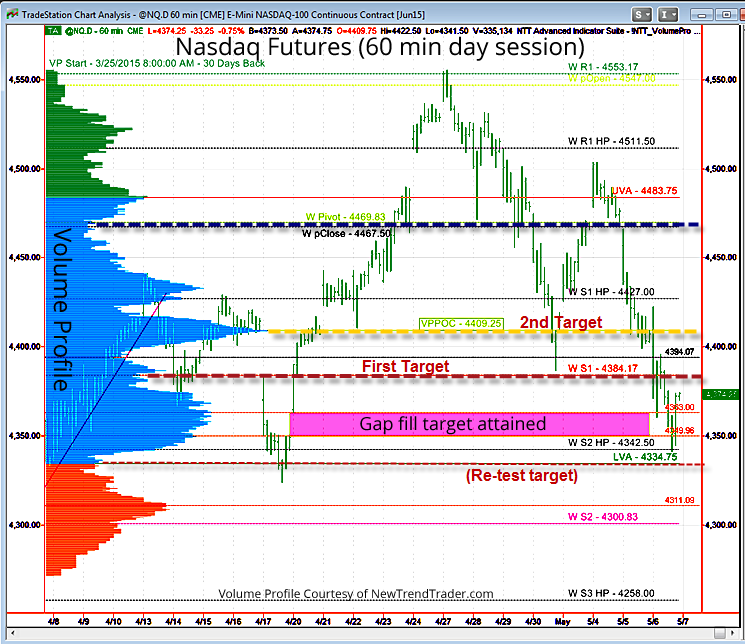

We now have the normal bounce and I have identified some near term targets for it: Weekly S1 at 4384 and the Volume Profile Point of Control at 4409. While an up-move is expected, this is earnings season and anything can happen overnight.

If the market decides to re-test Wednesday’s low (4341.50) it is likely to go all the way to the Lower Value Area (LVA) at 4334, the red dotted line on the chart. As always, have a plan and a target… and be prepared for anything.

###

A Note on Volume Profile

The histogram on the left side of the chart shows the volume distribution in the Nasdaq futures for different periods of time. Key support and resistance levels are indicated by the peaks and troughs. If you would like to receive a primer on using Volume Profile, please click here: www.daytradingpsychology.com/contact

Related Reading: