Yesterday

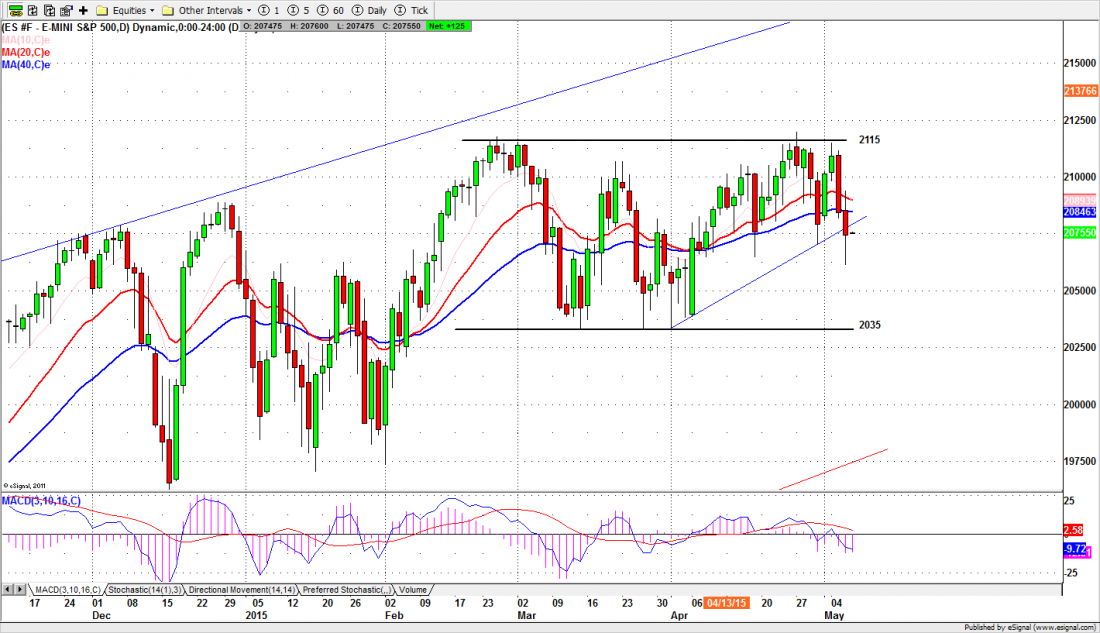

On Wednesday the &P500 mini futures (ES) closed just below 2074.25, about 10 points below the previous day’s close and a full 40 points below the high made on Monday. That was the good news. The bad news is that it made a low for the day at 2061.25 – a break below the lower boundary of the ascending triangle pattern the market has been in for several weeks. The volume was the highest of the week, and about 80% higher than Monday.

The futures opened low and went steadily lower throughout the day until the last hour, starting with a disappointing ADP employment report in the pre-market, and a speech by the Fed Chair that didn’t reassure the Street about interest rates.

It is too soon to declare that Wednesday’s price action constitutes a break-down of the market’s triangle pattern and is likely to be the first sign of further declines to come. There have been several false breakouts from the iron triangle in the recent past, and each one failed to follow through. We don’t know yet if this downside break is real or fake.

But some ind of break in this pattern is overdue, and certainly Wednesday’s movement will raise the anxiety level in the market. There may be a price reversal, as there has been with previous break outs. But it will need to do something substantial – a new high for example– before the frightened Bulls come back in force

Today

Today 2085-88.75 returns as the first resistance zone. If that resistance fails to Hold the price down it could trigger a short squeeze and push the price back up to 2096.50-2100 zone.

2075 is the key line. Remaining below it will give the impression that the intermediate-term bottom is likely to be tested again. A further sell-off should be expected if ES fails to move above the 2079.50-80.50 zone in the morning session and later moves back below 2075 line.

Major support levels for Thursday: 2062-59.50, 2051.00-53.00, 2045-42.75, 2029.25-28.50;

major resistance levels: 2096.75-95.50,2101-03.75, 2123.25-21.50

###

Naturus.com publishes a free weekly analysis of US equity indices. You can get on the mailing list at this link.

Related Story: