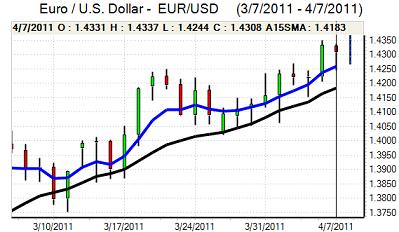

EUR/USD

With the US currency unable to make much headway, the Euro drifted only slightly weaker ahead of the ECB interest rate decision on Thursday. As expected, the central bank increased interest rates by 0.25% to 1.25% following the council meeting.

In the press conference following the decision, President Trichet stated that policy was still very accommodative and that inflation risks would need to be monitored closely. He also stated that there was no decision at this stage whether there would be a series of rate increases. The comments overall suggested that the bank would prefer to increase rates again, but that it will have to take a wait and see approach with no benefit from fuelling market expectations. The ECB maintained its commitment to providing unlimited liquidity through its money-market operations as there was a further delay in exiting from emergency measures.

The German economic data remained strong which provided underlying support for the currency, although this also illustrated powerful divergence within the Euro area. The lack of hawkishness from Trichet initially pushed the Euro weaker with a low just below 1.4250, but it regained ground quickly as the dollar was unable to secure strong buying support.

Regional Fed President Lacker stated that a rise in US interest rates was possible before the end of 2011, but markets remain unconvinced that Chairman Bernanke is willing to follow this path. The US currency was also unsettled to some extent by the threat of a government shutdown, especially as it reinforced medium-term fears over the US budget position. Partly in response, the Euro rallied strongly again in Asia on Friday with a high of 1.44 against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped briefly to the 84.60 area against the yen on Thursday as the Japanese currency spiked stronger following another powerful earthquake. The yen gains were short-lived as the US currency was able to regain the 85 level.

Underlying risk appetite remained strong and there was further interest in using the Japanese currency as a funding currency for carry trades.

The latest Finance Ministry data recorded net buying of overseas bonds by Japanese investors following the March earthquake which will tend to dampen expectations of capital repatriation and this will tend to be a negative factor for the Japanese currency. From a medium-term perspective, there will be a lack of confidence in the Japanese fundamentals as the debt burden continues to increase. The dollar consolidated above the 85 level on Friday with the Japanese currency still vulnerable on the crosses.

Sterling

Sterling edged weaker ahead of the Bank of England interest rate decision on Thursday with ranges generally narrow as caution prevailed. The central bank left interest rates on hold at 0.50% and also held quantitative easing at GBP200bn. This was the expected outcome, although there had been some speculation over an increase and the UK currency weakened following the announcement.

There was no statement and the vote split will not be released for 2 weeks. There were no further UK data releases and the next focus will be on inflation pressures with the producer prices data due to be released on Friday followed by the consumer inflation data on Tuesday

Sterling should gain some support from generally benign risk appetite conditions. Euro-zone developments will also be watched closely and there will be a significant impact on Sterling with markets uneasy over the implications for the UK banking sector.

Sterling found support near 1.6250 against the dollar and advanced to a peak near 1.64 in Asia on Friday as the US currency was subjected to wider selling pressure.

Swiss franc

The dollar was unable to make an impression on resistance above the 0.92 level against the franc on Thursday and weakened sharply to lows near 0.91 as the US currency was subjected to wider selling pressure. The Swiss currency was broadly resilient on the crosses, although there was Euro support below 1.31.

The widening of interest rate differentials will tend to sap franc support to some extent against the Euro, although there will also be speculation that the National Bank will look to tighten policy at the June meeting. There will still be the potential for defensive capital inflows as Euro-zone stresses continue.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

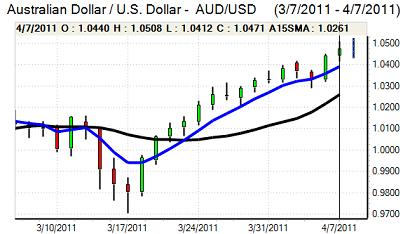

Australian dollar

The Australian dollar dipped briefly to lows just above 1.04 against the US currency on Thursday, butt here was further strong buying support on dips and it pushed to fresh 29-year highs above 1.0520 during local trading on Friday.

Risk conditions remained generally favourable which encouraged a further flow of funds into high-yield currencies. The local currency also continued to gain support from the very high level of gold prices and general strength of commodity prices. There were no fresh domestic data releases during the session as risk conditions dominated.