Over the last few years it’s been ‘normal’ to see high yield bonds underperform equities. When stocks have faltered during the last three years, the iShares High Yield Corporate Bond ETF (HYG) has picked up some relative performance as traders shift into the typically lower-beta portion of the market.

However, while stocks have taken a breather since mid-May, HYG does not seem to be the haven traders have sought after like they have in the past as it is now down nearly 5% from its 2013 high.

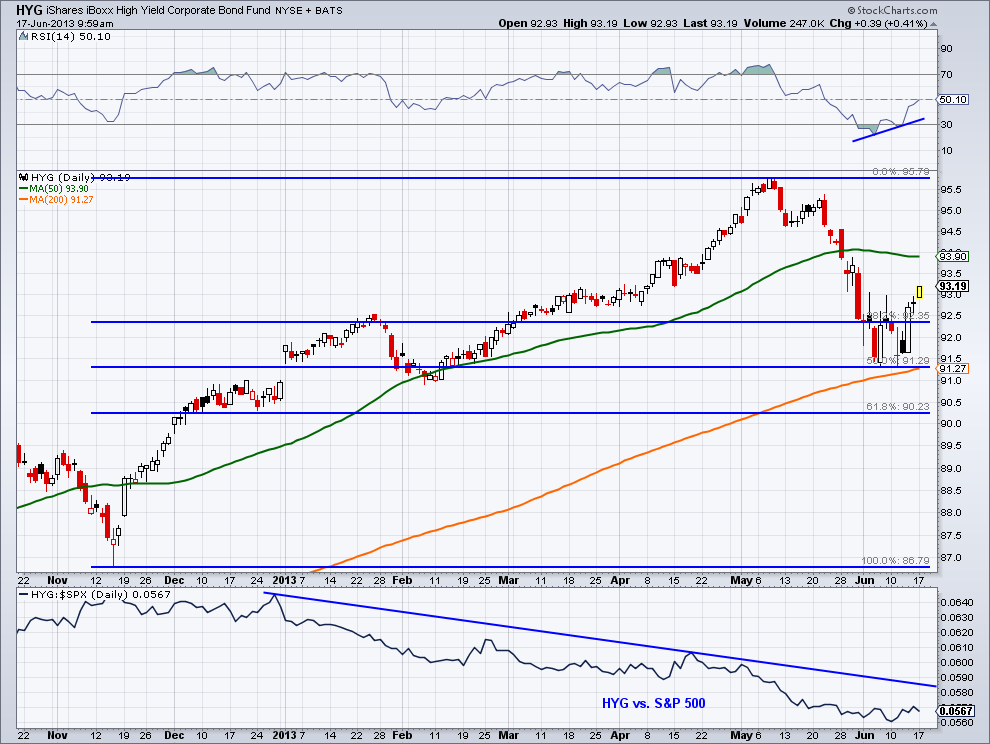

With this weakness it seems high yield corp. bonds have found some support. Looking at the uptrend that began in November and was halted in May, HYG has retraced 50% of the move. This is healthy and commonly viewed as normal market action. The bond ETF has been able to stay above its 200-day moving average (orange line), which has continued to rise and may act as additional support if HYG drops further.

Looking at momentum, we have a positive divergence off oversold levels. Price put in a double bottom as the Relative Strength Index created a higher low as shown in the top panel of the chart. Ideally we would like to see RSI put in a lower low that’s above 30, and we were very close with the low last week but still had a slight dip into oversold territory.

Looking at the relative performance of against the S&P 500 (SPX), high yield corporate bonds (HYG) are still well below the falling trend line. We can also in the bottom panel of the chart that the ratio between HYG and SPX is continuing to make lower lows – not a bullish sign for HYG’s relative performance against the equity market.

Going forward I’ll be watching to see if high yield corporate bonds are able to dig their feet in and build up some relative strength against stocks and test the falling trend line. If price is able to appreciate then the 50-day moving average (green line) may come in to play. If the bond ETF weakens then we can see how it reacts to previous support near $91.50 and its 200-MA.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.