When investors and traders examine the macroeconomic landscape looking for opportunities, it’s quite a myriad of contrasts. We have interest rates at all time lows and investors are incapable of earning any yield in the Treasury market. Stocks when measured against historical valuations are trading at the highest levels in history. Likewise, Real Estate and housing has never been more unaffordable. The alternative asset class of the Crypto market has seen its greatest run in financial history. All of this has occurred against the largest money supply increases in the history of the world. It is against this “Everything Bubble” backdrop that the worlds greatest investor Warren Buffet released his most recent letter to shareholders of Berkshire Hathaway.

Every year dating back to 1965, Buffett, the greatest investor of our generation, releases his annual letter to shareholders. It is public and anyone can read it. The Buffett annual letter has been so popular over the years, that these letters have become a required read across the investing world, providing insight into how Buffett and his team think about everything from life, investment strategy, mistakes, company culture, and more. It’s not uncommon for the content of these letters to join the lexicon of analysts, media, investors, and traders. For example:

“Price is what you pay, value is what you get.” (2008 letter)

“Be fearful when others are greedy and greedy when others are fearful.” (2004 letter)

“You only find out who is swimming naked when the tide goes out.” (2001 letter)

Today, Mr. Buffett aka the “Oracle of Omaha” has a net worth of around $85 billion, making him the fourth wealthiest person in the United States after Jeff Bezos, Bill Gates, and Mark Zuckerberg. Berkshire Hathaway, Buffett’s firm, has the most expensive share price of any company in history, with each Class A share costing upwards of $330,000.

Throughout history, few investors have been more successful than Buffett. Since 1965, Berkshire Hathaway’s stock has averaged an annual gain of over 20% for shareholders. That is almost double the 10.2% total return, inclusive of dividends that the S&P 500 has averaged over the same period. Over 56 years, the S&P 500 has returned 23,454% while Buffett has gained 2,810,526%. If you had invested $1,000 in Berkshire Hathaway in 1964 it would be worth over $28 million today.

In early 2020, Buffett’s partner, Charlie Munger warned of “wretched excesses” in the financial markets before the pandemic, economic lockdowns, and ensuing stock market selloff took effect.

Berkshire Hathaway is sitting on over $147 billion in cash. They are often criticized for this, but Buffett and Munger stick to their value investing philosophy and refuse to chase equities with frothy premiums. The Berkshire Hathaway philosophy has been to find businesses that offer long term sustainable competitive advantage and to own them “forever.” Buffett, 90, has struggled for many years to find attractive deals that would deploy his cash into higher-returning assets to help supercharge the growth of Berkshire Hathaway. Most recently, Buffett used $6 billion of his cash pile to buy into Japanese trading houses as well as making purchases into natural gas assets.

Chief Takeaways from the 2020 Berkshire Hathaway Letter

Buffett warns about the risks in the fixed income marketplace:

“And bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.”

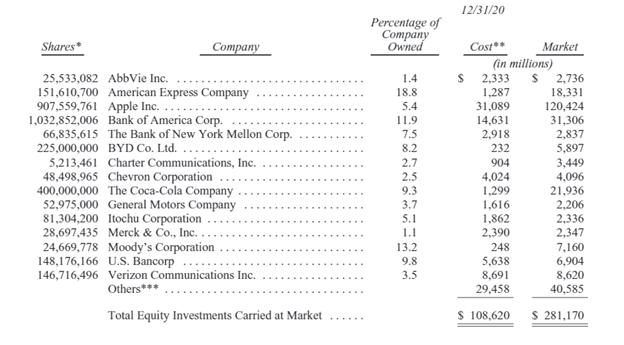

Buffet lists his conglomerates top holdings, which are quite impressive.

Buffett continues to be a cheerleader for America. He unequivocally references the “great American tailwind” and discusses his always-bet-on-America philosophy. His perspective is that if you look at the history of American financial markets it has always gone from the lower left-hand corner to the upper right. Aside from the occasional pullbacks, recessions, or bear market it has always gone up. This sentiment should not come as any surprise to anyone who has studied Buffett over the years. He portrays himself as the eternal optimist.

But I read the letter and walked away a little confused. I believe Buffett is genuine on his betting on America philosophy. But it is important to balance Buffett’s words with what his actual actions were in 2020. What did he actually do with his money?

It was a little surprising though that he did not make any significant investments during the March 2020 market downturn. If anyone has the balance sheet to strike during a crisis, it is Warren Buffett and Berkshire Hathaway.

So why didn’t they invest any of their $147 billion during a market downturn that saw stock prices fall approximately 30%? Is that market that overvalued according to Buffett that even a huge correction will not entice him to strike?

Back in 2008, Buffett was the go-to guy who provided distressed financing for companies who were hurt by the Great Financial Crisis. Why didn’t he provide financing to any distressed companies in 2020? Surely there is no shortage of companies who were adversely affected by the economic lockdown. Or why didn’t Buffett seize the opportunity to buy a business or two when certain investors were experiencing a massive cash flow liquidity crisis?

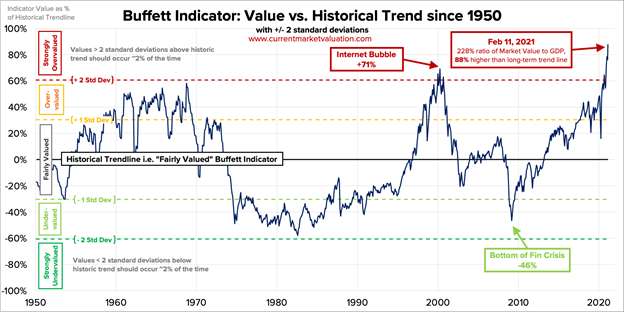

Buffett created an economic indicator that is kept current by the St. Louis Federal Reserve. This indicator has been screaming that the market is massively overvalued for a long, long time. As a matter of fact, we would have to fall 40% to reach the peaks of the dotcom bubble highs which were seen in 2000.

The Buffett Indicator is a ratio used by investors to gauge whether the market is undervalued, fair valued, or overvalued. The ratio is measured by dividing the collective value of a country’s stock market by the nation’s GDP.

The most obvious assumption we can make is that Warren Buffett may believe the worst is yet to come. In other words, he could be waiting for another market downturn that drives asset prices even lower than we saw in the first liquidity crisis of 2020.

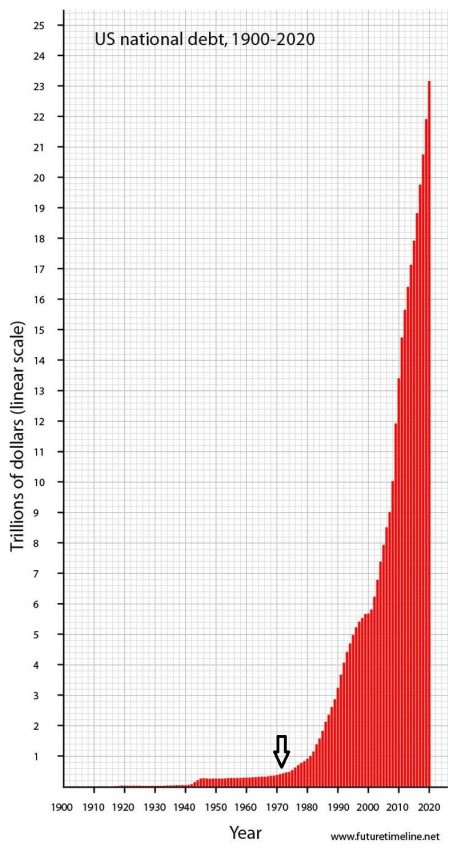

Another explanation could be that the Fed has printed too much money in the past year to make sense of all of the financial distortions which are occurring. Berkshire did very well helping distressed companies after the 2008 Financial Crisis. The chart below highlights the explosion of debt that has occurred since 1971 when President Nixon shut the Gold window and turned the world into 100% fiat universe.

Last year I wrote a about Buffet buying GOLD as the Fed started printing trillions of dollars. I did not see any references in his most recent letter to that specific trade or his outlook on inflation.

But all this pro-America talk does not change the fact that Warren Buffett has not deployed any capital during any of the recent market chaos or uncertainty. The reality is he liquidated all of his airlines only to see them rebound after he announced his liquidation. Buffett had refrained from investing in the airlines for decades. He specifically wrote about them multiple times to explain that he did not believe airlines were great businesses.

This year, Buffett admitted to paying too much for Precision Castparts Corp, an industrial aircraft parts maker. He acknowledged writing off $11 billion because of his poor judgment. (It is rare you get to see the 4th richest person in America admit to making a mistake.) Buffett is a staunch “buy and hold” advocate who often quips that the best holding period for a stock is forever.

My biggest takeaways from reading the Buffett shareholder letter is Buffett is being incredibly cautious in this “Everything Bubble” macroenvironment. Charlie Munger once commented that “it is remarkable how much of a long-term competitive advantage they have gotten by trying to consistently not be stupid, instead of trying to be very intelligent.”

We’ll be watching the Oracle of Omaha closely over the coming weeks and months to determine if he is genuinely optimistic on America by actually deploying his $147 billion in cash into any of the financial markets.

While it’s fun to think about all the possibilities regarding Berkshire Hathaway’s actions, it’s situations like this which can also paralyze investors and traders.

The bottom line, is what do you do with this kind of information? How do you make sense of the massive disruption that the “Everything Bubble” portends for traditional finance? Buffett quips in this shareholder letter, quoting Ronal Reagan, “It’s said that hard work never killed anyone, but I say why take the chance?”

There aren’t enough hours in a day for you to be able to make sense of these monumental changes affecting the financial markets manually. This is why in 1991, Louis Mendelsohn introduced artificial intelligence as the ideal quantitative solution for traders and investors.

Think long and hard about HOW you are going to trade the markets if you do not have an edge. As the volatility of the last decade becomes commonplace are you prepared for the disruption that wild volatility will create?

Think about those losing trades and ask yourself what did you learn from that experience? What is your method for analyzing risk? What is your systematic framework for defining opportunity?

Let me lay it out for you in black and white.

Two traders looking at the same market at the same time.

One is armed with artificial intelligence.

The other is not.

Who do you think is better prepared to win in this scenario?

Knowledge. Useful knowledge. And its application is what ai delivers.

Artificial intelligence is not “a would be nice to have” tool.

It is an “absolutely must have” tool to flourish in today’s global markets.

Machine Learning is designed to learn from experience and make the best statistically relevant decision moving forward. A.I. outperforms human analysis hands down every time.

We live in very exciting times.

What hurts others can instruct us.

A.I. is the framework where risk and opportunity are very clearly defined.

Remember, artificial intelligence has decimated humans at Poker, Jeopardy, Go! and Chess. Why should trading be any different?

Visit with us and check out the a.i. at our Next Live Training.

Discover why Vantagepoint’s artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count.

IMPORTANT NOTICE!

THERE IS SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.