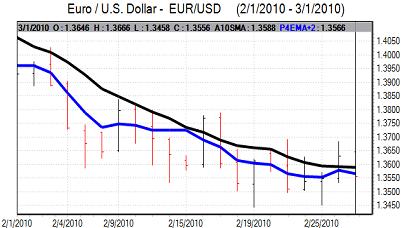

EUR/USD

The Euro was unable to push above the 1.3650 level against the dollar on Monday and was subjected to sharp selling pressure ahead of the US open with a slide to a low near the 1.3450 level.

There were important developments on the crossesas the dollar gained strongly against Sterling. This demand for the US currency also pushed the dollar sharply higher against the Euro as there were rapid movements.

There was further uncertainty over the situation surrounding Greece with doubts over the potential for support measures for the country while there was unease over the risk of further protests against fiscal measures within Greece which would risk increased tensions with Germany.

The US ISM data was slightly weaker than expected with a dip to 56.5 for February from 58.4 the previous month. The data was still relatively strong compared with the past 12 months and there was a further increase in the employment component which will lead to hopes that there will be a recovery in manufacturing employment within Friday’s payroll data.

Fed Governor Kohn announced that he would resign from the Federal Reserve in June and this may lead to a slightly more hawkish tone from the Fed as regional banks will have a stronger presence on the FOMC committee while chairman Bernanke will tend to be more isolated.

The Euro found support below 1.35 and recovered to the 1.3530 later in the US session as market tensions and volatility eased slightly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar continued to find support below the 89 level against the yen on Monday, but was unable to strengthen above the 89.50 level. The Euro weakened to re-test support close to 120 against the Japanese currency before finding some support as cross-market moves had an important impact during the session.

The yen continued to gain protection from a lack of confidence in the Euro-zone and there is likely to be speculation over capital repatriation from European bonds which would also tend to underpin the yen.

Sterling

Sterling was subjected to renewed selling pressure on Monday and there was very heavy selling in the middle of the European session as a break of the 1.50 support level lead to an acceleration of downward pressure with stop-loss and speculative selling apparent. There was a decline to 10-month lows just below the 1.48 level against the dollar before a recovery. The Euro pushed to a high near 0.91 against the UK currency.

There were further concerns over the UK government debt situation and the fears were amplified by an opinion poll which suggested a high risk of a hung parliament in the general election which is likely to be held in May. An indecisive outcome would make it more difficult for the budget deficit to be reduced.

UK insurance group prudential confirmed that it was in advanced talks to buy AIG Asian operations for GBP23.5bn and this was also a negative factor for Sterling given expectations of heavy capital outflows.

The manufacturing PMI data was unchanged from the previous month at 56.6 while there was a stronger than expected reading for mortgage lending which should provide some degree of relief.

Swiss franc

The dollar found support close to 1.0720 against the franc on Monday and pushed sharply stronger ahead of the US open with a high around 1.0870 before consolidation near 1.08. Despite volatility against the dollar, the Euro was little changed near 1.4630 against the Swiss currency.

The Swiss PMI index was stronger than expected with an increase to 57.4 from 56 the previous month which should maintain an optimistic tone for the economy after a firm reading for the KOF index on Friday.

Persistent stresses within the Euro-zone will remain an important source of support for the franc in the short term.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

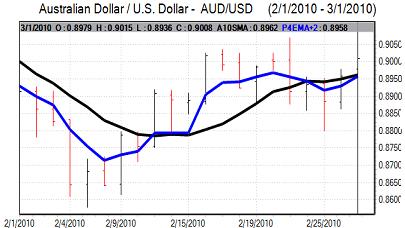

Australian dollar

The Australian dollar dipped to lows near 0.8935 against the US dollar on Monday before finding support and edging back to the 0.90 region during the US session.

Markets continued to expect an interest rate increase by the Reserve Bank of Australia which provided underlying support for the currency, but there may be the risk of selling after the decision.