EUR/USD

The Euro continued to test resistance levels close to 1.47 in European trading on Wednesday, but was unable to break through with the currency blocked in part by defence of option barriers while there were also reports of Asian central bank selling.

The currency was subjected to renewed selling pressure during the US session with lows near 1.4560. There were media reports that the IMF report on Greece would indicate that the next Greek tranche payment could not take place without corrective action on failure to meet existing revenue targets. The reports triggered fresh fears over the Greek default risk and undermined the Euro as choppy trading persisted.

There were still expectations that the ECB would take a tough tone following Thursday’s council meeting and signal a probable interest rate increase in July through the use of the term strong vigilance on inflation. Such language would provide near-term Euro support, although the backing may not prove to be durable. If there is more dovish language from President Trichet, then the currency will be vulnerable to significant selling pressure.

The Federal Reserve’s Beige Book reported that the expansion continued, although there was some deceleration reported by a few districts. There will be further market fears over an underlying slowdown in the economy. There was further unease over the US debt-ceiling negotiations as failure to raise the debt ceiling would trigger a high risk of technical default which would compromise the US credit rating.

There were increased fears over the global economy which triggered a deterioration in risk appetite and provided some defensive support for the US currency, offsetting a lack of confidence in the fundamentals. The Euro was able to push back above 1.46 on Thursday ahead of the ECB decision.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar remained under selling pressure against the yen during Wednesday and dipped to lows just below 70.70 before finding some degree of support, although it remained below the 80 level during the US session. The dollar was again hampered by a lack of yield support following the recent weak data releases. There was no evidence of G7 intervention on dips to below 80, but markets were still on high alert over the intervention risk.

Global risk appetite remained weaker on increased fears over the growth outlook and this also triggered some defensive demand for the Japanese currency.

Domestically, a small improvement in consumer confidence did not have a significant impact on market sentiment and the dollar rallied slightly in Asian trading on Thursday.

Sterling

Sterling was subjected to sharp selling pressure in the European session on Wednesday following a report from ratings agency Moody’s that the UK AAA credit rating could come under threat due to fiscal slippage. The report reinforced a lack of confidence in the economy, especially as there has already been criticism that the government is tightening policy too fast.

Monetary policy will also remain an extremely important focus with further expectations that the Bank of England would need to be extremely cautious over raising interest rates. The overall policy mix will continue to combine a tight fiscal policy with low interest rates and markets are not expecting the bank to tighten on Thursday. Sterling will, therefore, jump higher if there is a rate hike at the MPC meeting.

Sterling did prove to be resilient during the US session and edged back towards the 1.6420 region against the dollar as the Euro was subjected to profit taking.

Swiss franc

The dollar continued to find support below 0.8350 against the franc during Wednesday, but the US currency was capped below 0.84 as the Euro lost further ground on the crosses.

The combination of fears over the global growth outlook, allied with renewed fears over the Greek outlook, has triggered fresh safe-haven demand and the franc will tend to maintain a robust tone as it retains its premier safe-haven status.

There were reduced speculation that the National Bank would increase interest rates which may dampen currency demand to some extent.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

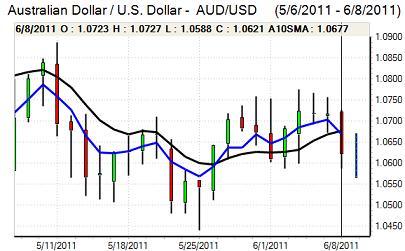

The Australian dollar dipped to below 1.07 against the US dollar during Wednesday and tested support levels just below 1.06 before finding some degree of support.

The currency was again undermined by a deterioration in risk appetite as unease over the global growth outlook increased. There will also be fears that any slowdown in the Asian economy would put downward pressure on commodity prices which would also tend to weaken the Australian dollar.

Domestically, the latest labour-market data was weaker than expected with May’s employment gain held to 7,800 following the revised 29,400 decline the previous month and full-time employment dropped for the second successive month. The data increased fears over a sharp economic slowdown and the Australian dollar weakened to test support below 1.0580.