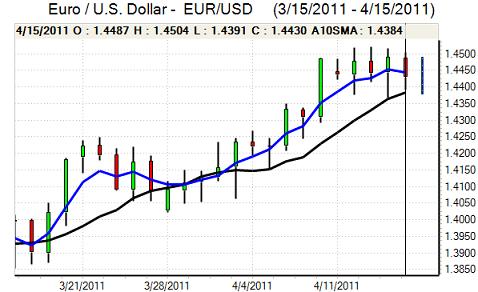

EUR/USD

The Euro was again unable to break resistance in the 1.45 area during Friday and retreated to test support close to 1.44 with some reduction in long Euro positions ahead of the weekend.

In the Finnish general election, the governing social democrats suffered large losses and there will be a new coalition led by the National Party. The anti-European True Finn party did make strong gains and may join the coalition which will maintain fears that Finland could reject bailout support for Portugal

Yield spreads on Greek debt have also failed to narrow and there has been increased speculation that a default is unavoidable, especially as internal opposition to the current policies is increasing. Markets remained on edge over the default risk, especially as it would trigger fresh vulnerability in the Euro banking sector. Political and sovereign risk fears pushed the Euro to test support near 1.4350 on Monday and there will be the potential for a further reduction in long speculative Euro positions from a 40-month high.

Friday’s US data was generally supportive for the growth outlook with a stronger than expected 0.8% increase in industrial production for March while the New York manufacturing PMI index rose to 21.7 for April from 17.5 previously. The headline CPI release was in line with market expectations at 0.5% while the core increase was slightly lower than expected at 0.1%. The benign core reading reinforced market expectations that the Federal Reserve will not tighten policy this year and this remained an important negative factor for the dollar.

With the Federal Reserve meeting due to be held next week, FOMC members will be reluctant to comment on monetary policy during the current week and the focus will tend to remain on Europe.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a challenge on the 84 area against the yen on Friday and weakened to test support near 83.0 with the yen gaining further relief on the crosses.

The Chinese central bank announced a further increase in the reserve ratio requirements over the weekend as gradual monetary tightening persisted. The mood tended to dampen risk appetite and also provided some degree of support for the yen.

The latest speculative positioning data indicated that yen shorts were at the highest level for 12 months which will maintain pressure for a reduction in positions and curb selling pressure.

The latest US data failed to provide additional yield support for the US currency, but there was still evidence of firm support on retreats and there were also reports that the Japanese postal savings fund Kampo was buying dollars.

Sterling

Sterling was blocked in the 1.6360 area against the dollar on Friday and drifted weaker to the 1.63 area in US trading. The UK currency was resilient against the Euro with a further correction from recent sharp losses as it pushed to 0.8820.

The latest Rightmove house-price index recorded a 1.7% monthly increase in prices for April, but this is certainly in part due to seasonal considerations and the annual change in prices was close to zero. There will be further unease over the housing sector given the pressures on consumer income levels. The Bank of England minutes will be watched closely on Wednesday to assess the potential for a near-term interest rate increase and the discussion will be particularly important if the MPC had been briefed about the latest inflation data at the meeting.

Euro-zone trends will also remain in focus, especially as there will be an important impact on the UK banking sector. Any default by Greece would increase UK banking fears and would tend to prevent Sterling being seen as a safe-haven.

Swiss franc

The dollar found support on dips towards 0.89 against the franc on Friday, but was unable to make any significant headway, especially as the Swiss currency retained a strong tone against the Euro.

Safe-haven considerations remained extremely important and there was further defensive demand for the currency in its perceived role as sole safe-haven global currency, especially with Euro-zone sovereign-debt fears increasing again.

The Swiss Finance Minister warned over the negative impact of franc strength, but also repeated that intervention was not an option.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

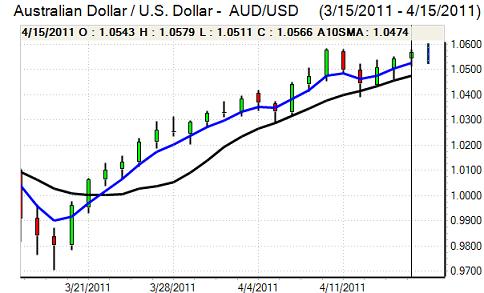

Australian dollar

The Australian dollar maintained a strong tone on Friday and after finding support in the 1.0520 area, the currency advanced again to test resistance near 1.0570 against the US dollar. The currency was able to maintain a firm tone despite a further increase in Chinese reserve requirements with no major domestic developments.

International trends will tend to dominate in the short term and any evidence of a sharp slowdown in Asian demand would tend to undermine the Australian currency on fears over the outlook for commodity prices.