Infinity Pharmaceuticals (INFI) and AbbVie (ABBV) announced on September 3 they will jointly develop and commercialize Duvelisib (Infinity’s oral inhibitor of phosphoinositide-3-kinase (PI3K)-delta and PI3K-gamma, for the treatment of patients with cancer) in the United States. Infinity will receive an upfront payment of $275M and $530M in potential milestones (currently has a market capitalization of just $764.3M).

Shares of Infinity Pharmaceuticals have an average analyst price target of $17.38 (2 hold ratings, 6 buy ratings, and 0 sell ratings). There is 10.03% short interest (4.5 days to cover). Wedbush upgraded the stock to neutral from underperform; raised the price target to $15 from $9. Also, Roth Capital maintained their positive rating after the announcement of the partnership with AbbVie.

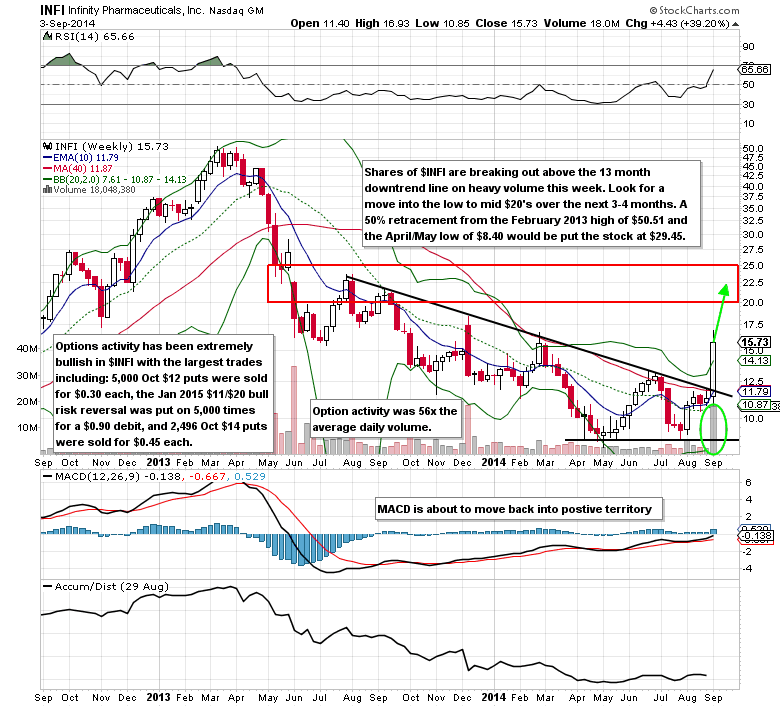

Unusual Options Activity

Option order flow was extremely bullish even after the 44% rise on Wednesday. The sellers of 5,000 Oct $12 puts for $0.30 each and 2,496 Oct $14 puts for $0.45 each are betting on limited downside over the next two months. When the underlying price was at $15.71-$15.72, someone put on 5,000 Jan 2015 $11/$20 bull risk reversals for a $0.90 debit (they bought the $20 calls and sold the $11 puts). He or she has a breakeven of $20.90 on January 2015 options expiration (32.87% above the current share price) and faces more than the initial risk of $450K below the $11 level. Total option activity was 56 times the average daily volume.

Infinity Pharmaceuticals Options Trade Idea

Buy the Jan 2015 $16/$22.50 call spread for a $2.00 debit or better

(Buy the Jan 2015 $16 call and sell the Jan 2015 $22.50 call, all in one trade)

Stop loss- None

First upside target- $4.00

Second upside target- $6.00

= = =

Mitchell’s Smart Money Report for unusual options activity featuring Citigroup (C)