It seems like everyone hates the Japanese yen these days. It’s hard to blame them, they are one the most indebted countries in the world, China has recently overtaken them as the second largest economy by GDP according to the IMF and World Bank, and Japan is still struggling to come back from the devastating tsunami that took place last year.

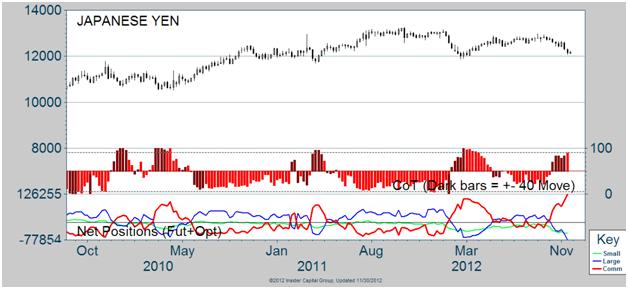

Below is a chart of the Commitment of Traders (COT) data for the yen. What we can see from this chart is that commercial traders or what is often called the ‘smart money’ (red line in bottom panel) has been increasing their net position in the yen for the last few months to historic highs. At the same time, large and small traders (blue and green lines, respectively), who are often made up of hedge funds and individual investors, are currently holding historically net-short positions.

As you can see, when the difference between commercial traders and large traders has gotten extremely wide with commercials being net-long the yen has typically found a bottom, as in early 2010, 2011 and March 2012. Normally the large and small traders don’t win these types of battles, especially when going against commercial traders as net-long as they currently are.

However, there are some strong winds that are blowing against the yen contrarian traders. The primary headwind for the yen is the large amount of monetary easing that’s being done by Japan. On November 30th, the Japanese government announced another round of QE, according to a recent WSJ article. There have also been discussions of extending the dollar-loan program, which Japan has used to help fight its high currency. In a few weeks we will learn the outcome of the Japanese election, which will likely shed some light on possible future government interventions and the ultimate impact on the Japanese yen.

Going forward I’ll be watching to see how the COT data shapes out in reaction the price action that takes place in the yen. We’ll see if the aggressive contrarians step in to short squeeze the bearish yen traders or if the political actions of the Japanese government backstop the large and small traders, continuing the yen’s decline.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.