The main reason Apple Inc. (AAPL) hasn’t been on my radar for a few months is because of the sideways movement. Ever since it hit my target of $388, some buying pressure started returning on AAPL.

However, regardless of how many people wanted to day trade AAPL this last month or so, it is trading totally and completely sideways without any directional movement. Unless you are a credit spread aficionado, it’s been hard to make consistent money these past few weeks.

Fear not traders, something is brewing in AAPL– brewing like a cup of java, in a small coffee shop in Nashville, TN that has concrete floors, a fire place filled with oak wood logs, intermittent leather and wooden chairs that do not match, random bags of coffee beans and a sea of skinny jeans wearing, wild hair, horrible fashion hipsters like you will only find in a coffee shop in Music City, Nashville.

WEEKLY CHART ACTION

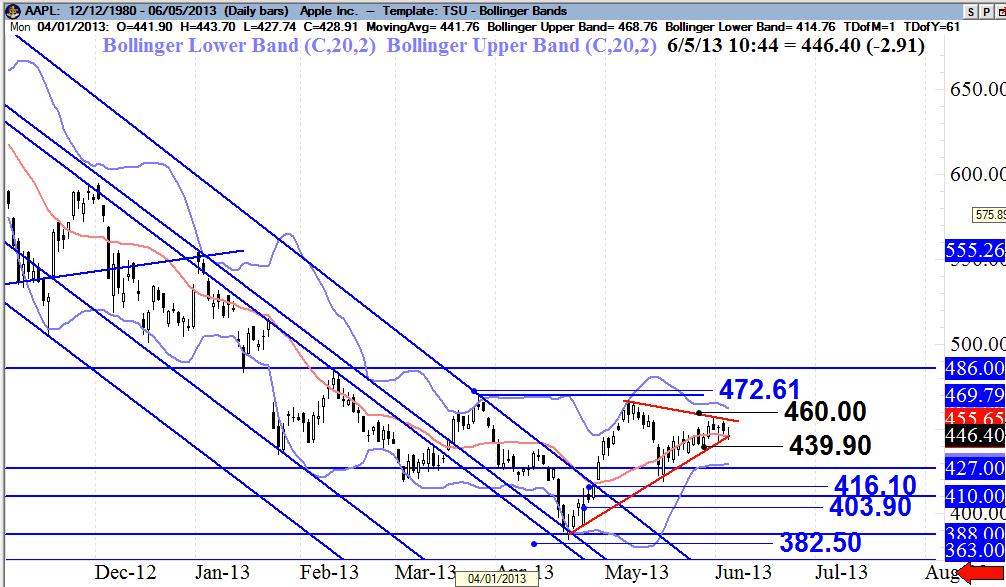

If you are able to peer at a weekly chart, you will notice that APPL’s price action is between the 20 and 10 exponential moving averages. On a daily chart, it is having an epic ‘Roman’ type of battle with the 100 simple moving average. Outlined in red, I believe AAPL is beginning to form a symmetrical triangle type of a pattern. It’s not quite as large as I would like it to be, however, many technicians believe AAPL is also forming a massive inverted head and shoulders pattern. I agree 100%.

KEY LEVELS

However, it still needs to confirm. A close above $472.61 would be the neck line of the inverted head and shoulders. The gap between $486 and $504 will be very strong and tough resistance to break. However, we likely would fill the gap, slowly over time, taking approximately 1 month if AAPL does close above $472.61.

I have other triggers in place. The black ones are to alert me of a significant move and potentially a break of the small triangle. If we close below $416.10, $403.90 and finally $382.50, my bearish outlook on AAPL, will become massively stronger. Failure once more of the $486 level creating a lower high once again, will likely result in a much lower fall for this apple from the stock heaven tree.

Let’s keep an eye on this one. When it moves, it will be with haste. Keep an eye on it and as always, mitigate your risk!

= = =

Read the TraderPlanet Summer Journal–a free quarterly trading education publication.

Top picks from the Summer edition:

Read an exclusive interview with StockTwits founder Howard Lindzon.

Steve Miller (AskSlim) dives into the Myth of the Undervalued Stock Market.

Warren Buffett Is Wrong When It Comes to Losing Money. Jason Leavitt explains.