CBS (CBS), the mass media company, is expected to grow EPS by 15.5% and revenue by 2.5% in 2014. They currently trade at a forward PEG ratio of 1.12. On January 15, Nomura initiated CBS with a buy rating and a price target of $75. CBS is expected to announce Q4 earnings on Wednesday, February 12th.

Options Activity

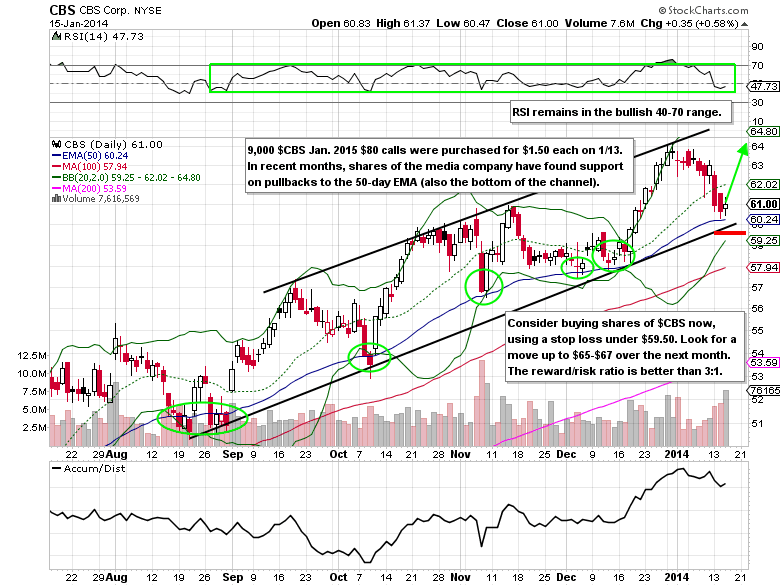

Two days before the Nomura initiation, someone purchased 9,000 Jan 2015 $80 calls for $1.50 each ($1,350,000 bet). He/she thinks the stock will close above $81.50 on January 2015 options expiration. Also, there was more bullish options activity on January 15, as nearly 7,000 Feb 2014 $65 calls traded for $0.55-$0.75 each. Most of these calls were bought, bringing the net call premium to +$210K for the day. The call to put ratio finished at 26.31.

The Technical Take

Shares of CBS have pulled back over the last couple of weeks to the bottom of the uptrending channel (also the 50-day exponential moving average). Today, the stock bounced off of support, rising 0.58%. Using a stop loss under $59.50 on a stock position, the reward/risk ratio is better than 3:1.

CBS Options Trade Idea

Sell the Feb 2014 $55/$60 bull put spread for a $1.15 credit or better

(Sell the Feb 2014 $60 put and buy the Feb 2014 $55 put, all in one trade)

Buy stop loss reference- A move below the $59.50 level

Upside target- $0.00 (30% gain)

= = =

See Mitchell’s Smart Money Report for unusual options activity featuring T-Mobile US (TMUS) here.