As an investor, you are like the conductor of your portfolio.

Great conductors of a symphony orchestra share many qualities with successful investors – they have their eyes in many places, they make sure all of the moving parts they manage are working together in proper balance, and they must actively manage each section of the whole (whether it be instrument section or investment type) to endeavor to ensure success.

BONDS

Government and corporate bonds are like the bass section of the orchestra. The bass section doesn’t really stand out, doesn’t really do anything flashy, but it does provide a foundational sound for the rest of the orchestra to utilize. Just as if an orchestra was overweight tubas and baritones would probably be a pretty boring evening at the opera, a portfolio that is overweight fixed income products is probably too conservative for many investors and will potentially not provide the performance desired by most investors, especially pre-retirement.

DIVIDEND STOCKS

I believe dividend paying, mid to large cap stocks (and REITs) are like the percussion. Percussion keeps a steady, reliable beat and provides the framework for more spontaneity to occur in the portfolio without flying too far off the deep end. Even though dividend paying stocks can of course still decrease in value, the bottom line is that they do offer some repeatable income stream (barring any changes to the payout amount/schedule), which is a wonderful element to an overall portfolio. Great percussion makes the music sound a lot better, it can really make the more exciting melodies stand out even further thus creating a more balanced enjoyable listening experience.

Similarly, the dividend paying stock portion of your portfolio is designed to allow for potential growth to occur via price appreciation, but also is designed to provide some respite of stock price volatility by giving you a monthly/quarterly/annual dividend payment, with which you could either buy more shares via DRIP, or just take the money as income. The trumpets and trombones could be equated to foreign equity and fund investments. These investments are a little bit flashier, you would notice it more if they stepped out of tune with the rest of the group, but could also provide more exciting returns and more interesting music when played correctly. But, if overweight foreign stocks and funds, one risks subjecting the portfolio to unnecessarily volatile performance, just as having an 40 piece orchestra consisting of 30 trombones and tubas would just sound terribly off and imbalanced.

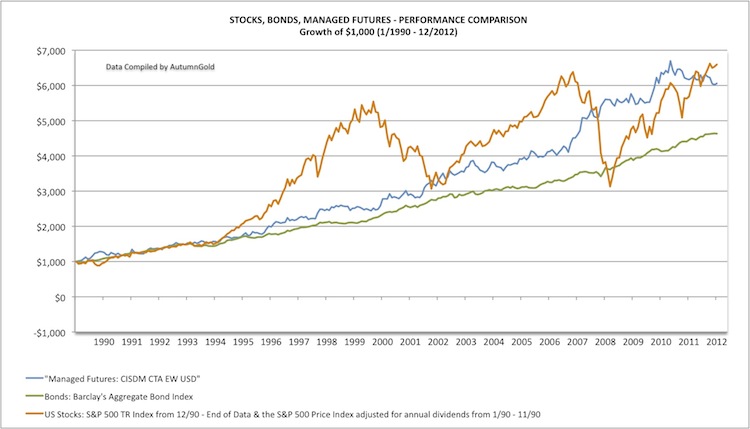

The final investment class I will discuss today is what are commonly known as alternative investments. Alternative investments range from hedge funds, private equity, real estate, to managed futures, and much more as well. Two of the main hallmarks of alternative investments are: 1) the general lack of correlation between alternative investment products and the broader equity indices, and 2) the potential for alternative investments to outperform traditional investment benchmarks. Obviously there are downside risks in alternative investments as well, and past performance is no necessary indication of future returns.

MANAGED FUTURES

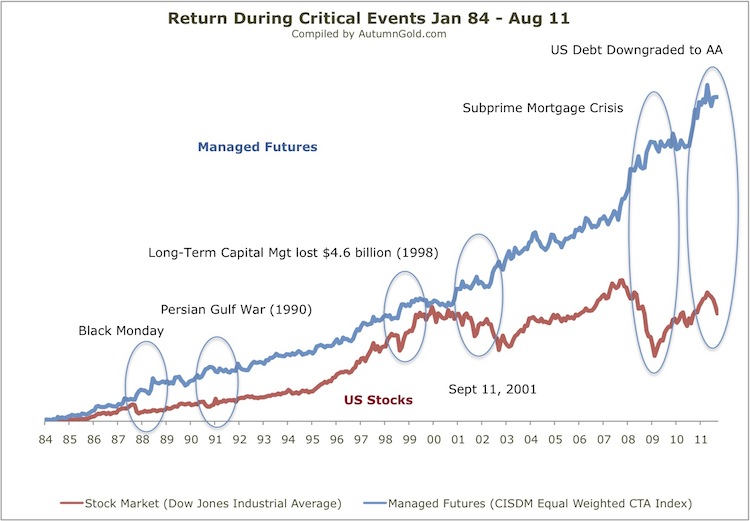

Take one famous alternative investment type – managed futures. One reason managed futures (which include managed options programs) became very well known to individual as well as institutional investors was how the overall investment type (measured by CISDM equal weighted CTA index) has performed during the various “critical events” that have hit the markets over the years.

Another reason managed futures programs have been increasingly a choice for investors to include in their portfolios is the unique combination of potential for lower overall volatility combined with potential for increased portfolio performance. Since managed futures and options programs are actively managed, the traders are constantly monitoring the risk of the positions and also trying to profit from both up and down moves in the market.

So, what instrument is managed futures? I say the best instrument that managed futures equates to is a saxophone. To have a brilliant saxophone player giving a wonderful solo in the middle of an evening at the orchestra, will provide a highly memorable, exciting, and inspiring experience for the listener.

THE BOTTOM LINE

Even if the rest of the symphony is having an off night, the saxophone solo will likely be a positive memorable experience and will take the edge off a sub-par symphony performance. To have a high quality managed futures/options program in one’s portfolio could be akin to having a great saxophone player in your orchestra – it will give you the ability to excite and inspire potentially higher returns than your other investments, but when the market is feeling a bit off, and having a down year, managed futures might just be the perfect solo to keep your spirits up.

PAST PERFORMANCE IS NOT NECESSARILY INDICITIVE OF FUTURE RETURNS. THE VALUE OF INVESTMENTS MAY GO DOWN AS WELL AS UP.

= = =