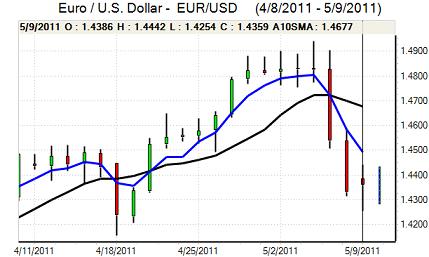

EUR/USD

The Euro consolidated for much of the Europeans session on Monday, but was unable to break above the 1.4450 area and was then subjected to renewed downward pressure. Euro-zone structural concerns and sovereign-debt fears were again the trigger for a sharp retreat in the Euro at it hit lows near 1.4250.

Ratings agency Standard & Poor’s downgraded Greece’s rating to B from BB- while Moody’s warned over the probability of further substantial cuts within the next few weeks. The downgrades were expected, but reinforced the negative mood surrounding the Euro.

Markets know the situation surrounding Greek debt is unsustainable and there have been greater fears that political solutions to tackle the economic crisis will not be sufficient or enacted quickly enough to stabilise the situation. There is, therefore, an increased fear over a disorderly debt default or a Greek withdrawal from the Euro which would cause major stresses within the Euro-zone banking sector. European officials will be under strong pressure to find a workable solution ahead of a planned May 16th Euro-group meeting.

Commodity prices initially attempted to recover from last week’s sharp sell-off and this did provide some degree of support for the Euro, especially with the dollar still unable to derive any significant improvement in yield support.

The Euro recovered to the 1.4375 area in Asia on Tuesday before being subjected to renewed selling pressure and a retreat back to below 1.43.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was blocked in the 80.80 area against the yen during Monday and retreated to lows near 80.20 before finding support. The Japanese currency gained on the crosses as risk appetite deteriorated following the Greek credit-rating downgrade and this also pushed the dollar weaker.

Although regional Fed Governor Lacker stated that US interest rates could be increased before the end of 2011, underlying yield support for the currency remained weaker which also curbed buying support.

The yen was undermined to some extent by a recovery in commodity prices and by a stronger than expected Chinese trade surplus. There was also reluctance to buy the Japanese currency aggressively close to the 80 level given the potential for G7 intervention.

Sterling

Sterling was blocked just above 1.64 against the dollar during Monday and was subjected to heavy selling in New York trading with a decline to lows near 1.6260 before an equally rapid recovery to the 1.64 area.

The latest UK economic data was generally better than expected with a 5.3% annual increase in like-for-like retail sales according to the latest BRC report compared with a 3.5% decline previously. Data for both months is likely to have been distorted by the timing of Easter holidays and there will still be fears over underlying trends.

The RICS house-price index improved slightly to -21% for April from -23% previously which was a 10-month high for the index even though it remained in negative territory. Underlying confidence in the housing sector remained fragile, especially with the Halifax house-price index dropping 1.4% for April.

Markets will watch the Bank of England inflation report closely on Wednesday and a downbeat assessment of the economy would undermine confidence in the economy as well as supporting expectations of a very slow increase in interest rates. Sterling still gained protection from a lack of confidence in other major currencies with the Euro dropping to 0.8720.

Swiss franc

The dollar was blocked below 0.88 against the franc on Monday and retreated to lows near 0.8710 before consolidating in the lower half of this range. The Swiss currency continued to gain support on the crosses and tested support close to 1.25 following the Greek downgrade.

Fears over the Euro-zone sovereign-debt situation will continue to underpin the Euro in the short term. The European banking sector will also be watched closely and fresh stresses may have a mixed franc impact given that there are substantial debts carried in the National Bank bad-loan vehicle.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

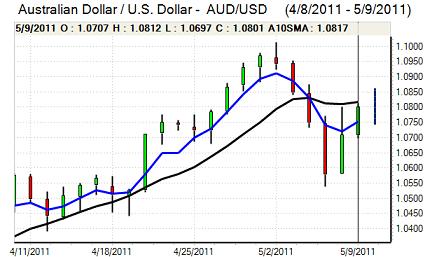

Australian dollar

The Australian dollar found support on dips to the 1.0720 area against the US currency during Monday and pushed to a high just above 1.08 before retreating. The Australian currency drew support from a rally in commodity prices even though market volatility remained high.

The latest trade data was better than expected with a AUD1.74bn surplus for march following a slight deficit the previous month and a stronger than expected Chinese trade surplus also provided some currency support.

The latest budget release on Tuesday will be watched closely and a restrictive tone would end to ease pressure for a further increase in interest rates.