METALS

December gold futures closed up $22.00 at $978.50 yesterday. Prices closed near the session high and hit a fresh nearly three-month high today. A weaker U.S. dollar and some increased investor uncertainty boosted gold yesterday. Prices saw a bullish upside “breakout” from the recent sideways trading range on the daily bar chart and the bulls do now have fresh upside near-term technical momentum. However, it will now be important for the gold bulls to show that important follow-through buying strength. Gold bulls’ next upside price objective is to push and close prices above major psychological resistance at $1,000.00. Bears’ next downside price objective is closing prices below solid technical support at this week’s low of $944.30. First resistance is seen at yesterday’s high of $981.40 and then at the July high of $993.60. Support is seen at the August high of $974.30 and then at $964.60.

Wyckoff’s Market Rating: 6.5.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

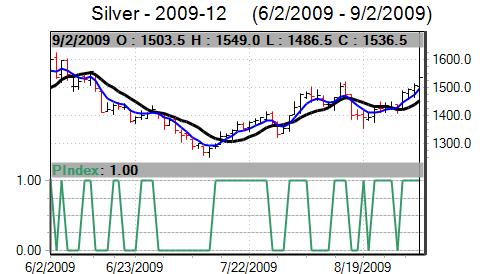

December silver futures closed up 34.0 cents at $15.40 an ounce yesterday. Prices closed nearer the session high today and hit a fresh 2.5-month high. Silver futures bulls have the near-term technical advantage and gained fresh upside technical momentum yesterday. Bulls’ next upside price objective is closing prices above solid technical resistance at the June high of $16.25 an ounce. The next downside price objective for the bears is closing prices below solid technical support at this week’s low of $14.55. First resistance is seen at today’s high of $15.49 and then at $15.75. Next support is seen at $15.225 and then at $15.00.

Wyckoff’s Market Rating: 7.0.

December N.Y. copper closed up 25 points at 282.10 cents yesterday. Prices closed nearer the session high yesterday. Coppers tepid gains today amid big gains in gold and silver should worry the bulls a bit. However, bulls still have the overall near-term technical advantage. The next downside price objective for the bears is closing prices below solid technical support at the August low of 266.00 cents. Bulls’ next upside objective is pushing and closing prices above major psychological resistance at 300.00 cents. First support is seen at yesterday’s low of 274.00 cents and then at 270.00 cents. First resistance is seen at 285.00 cents and then at 290.70 cents.

Wyckoff’s Market Rating: 7.0.