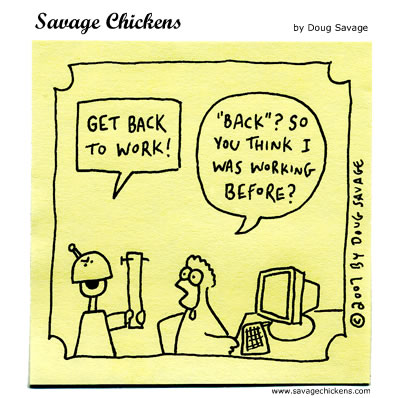

Welcome back!

Welcome back!

It’s always hard coming back off a holiday weekend. Not everyone is in the mood to work and not everyone even shows up. Europe isn’t showing up this morning as their markets are closed todaybut there’s no Easter Bunny inmainland China, where the Shanghai gained 2.8% and Taiwan gained 1.3%. The Nikkei was down 0.4% on the day but Hong Kong, Thailand (where they are rioting), Australia and New Zealand were all closed for Easter Monday. So, all in all, a very slow morning in the markets so far yet US futures have still managed to sinkabout a point as of 7:45.

That’s fine with us as we went into the weekend bearish, per the plan we had way back on Thursday morning, when I said: “We’ll be shorting into this morning rally because it’s stupid.” We half-covered our longer puts with May $79 puts, giving us plenty of room to fall and, had I realized Europe was closed today as well, I may have been a little more bearish because my concern Thursday afternoon was that Asia would fly up on us (like China did) and then Europe would follow and give us an extension of the rally. Having Europe closed is like engaging the parking brake in the morning as any continuation of this “rally” will require a lot of outside capital to start drifting into the US markets.

We presented two sides to the rally this weekend at PSW: Jeremy Siegel had a very interesting article asking “Is The S&P Valued Too Low?“in which he makes some very excellent points that the S&P follows a flawed model when it comes to computing overall p/es for the index. John Mauldin, on the other hand, is being sarcastic when he asks “Is ThatRecovery We See?” and he backs my long-term inflation premise saying: “There is a limit to continued $2-trillion deficits without the appreciable rise in interest rates that will be needed to attract buyers of Treasury bonds.” John gives us a definitive answer to his question and it’s – No! Have I mentioned I like gold lately?

Goldman Sachs hit the “no” button too, serving blogger Mike Morgan of www.goldmansachs666.comwith a cease and desist letter to get him to pull down articles like “Did Goldman-Sachs Scam System With AIG?“,”Did Lloyd Blankfien of GS Lie to Congress?“, “Does Goldman Sachs Manipulate the Stock Market?“, “Did Goldman Sachs Manipulate World Oil Prices?” and “Does Goldman…