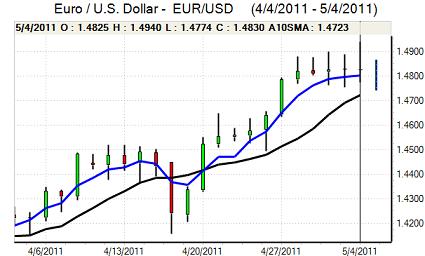

EUR/USD

The Euro found support below 1.48 against the dollar during Wednesday and gains accelerated during the US session with a fresh 17-month peak above 1.49 after the latest US data.

The headline US ADP employment report was slightly weaker than expected with a 179,000 private-sector job gain for April following a revised 207,000 increase the previous month. The figure dampened expectations surrounding the Friday payroll release, although the impact was subdued.

There was a much bigger reaction to the ISM non-manufacturing report which recorded a sharp decline to 52.8 for April from 57.3 the previous month. There was a sharp decline in business activity and new orders which will certainly cause concern and there was also a significant weakening in the employment component.

Fed officials took a generally dovish tone towards the economy and monetary policy in comments during Wednesday. The US data will reinforce expectations that the central bank will resist any move to tightening policy and there may be some fresh speculation over additional quantitative easing.

Thursday’s attention will focus on the ECB with the Euro gaining support on Wednesday from speculation that the central bank will take a more aggressive stance towards interest rates and could signal a further rate increase at the June meeting. The Euro will gain strong near-term support if the bank does take a tough tone, but the Euro will be vulnerable to heavy profit taking if the central bank is less hawkish than expected.

The economic data was weaker than expected with a 1.0% decline in retail sales for March, reinforcing doubts over the economy. The Euro also retreated sharply from its best levels as there was a sharp decline in commodity prices and a deterioration in risk appetite with a retreat to lows near 1.48.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar consolidated around the 81 area against the yen ahead of the New York open on Wednesday, but was then subjected to heavy selling pressure following the weaker than expected US ISM data. There was a further dip in US yields which undermined buying support for the US currency.

The evidence suggests that there has been strong fund buying of the US currency over the past few sessions, but the dollar has not been unable to gain any traction.

The yen will continue to gain defensive support if there is a sustained deterioration in risk appetite and a further decline in stock prices. Tokyo markets remained closed for a holiday and the dollar was trapped in the 80.50 area with selling curbed to some extent by speculation over further G7 intervention.

Sterling

Sterling was again undermined by weak data on Wednesday with the PMI construction index weakening to 53.3 for April from 56.4 the previous month. Mortgage lending remained subdued and there was another weak reading for money supply which will maintain fears over weak consumer spending. Sterling tested support below 1.6450 against the dollar and also weakened to a 13-month low beyond 0.9020 against the Euro before finding some support.

The data reinforced expectations that the Bank of England will resist any increase in interest rates at Thursday’s MPC policy meeting which also undermined yield support. The NIESR also downgraded its GDP growth forecasts and stated that the shortfall would prevent the government from meeting its borrowing forecasts.

Risk conditions will be watched closely and the UK currency will tend to be more vulnerable when there is a deterioration in market confidence.

Swiss franc

The dollar remained under pressure against the franc on Wednesday and dipped to a fresh record low near 0.8550 before finding some respite as the US currency recovered against the Euro. The Swiss currency maintained a strong tone against the Euro with a move to below 1.2750 and also hit fresh record highs against Sterling.

The franc will continue to gain support when there is a decline in commodity prices and falling equity prices. The franc will also gain some degree of support if there is a more dovish than expected ECB press conference while a tough stance would tend to weaken the Swiss currency to some extent even if safe-haven considerations dominate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

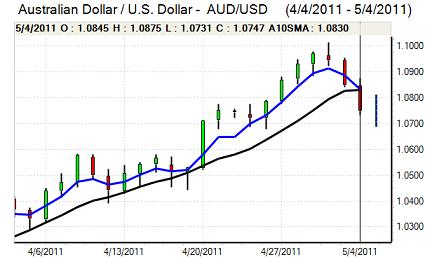

Australian dollar

The Australian dollar hit resistance close to 1.0850 against the US dollar during Wednesday and was subjected to fresh selling pressure late in the US session and tested support near 1.0720 as commodity prices weakened and equity markets also came under pressure.

The headline Australian retail sales data was weaker than expected with a 0.5% decline for March, although the previous month’s data was revised up slightly and there was a recovery in building approvals.

The Australian dollar dipped to lows just below 1.07 against the US currency before finding some support.