On Monday I wrote an article for Trader Planet with a target for the Nasdaq Futures of 4355. It took a while for the index to build a base of support, but the index closed just 10 points from that target on Thursday. The good news is that a critical technical indicator is now favoring even higher targets.

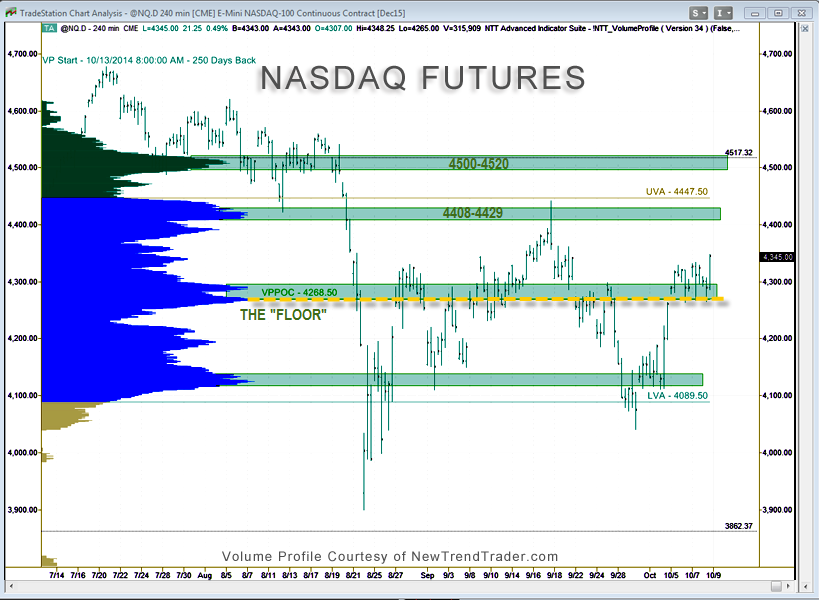

The indicator is Volume Profile and the base that the NQ built over the last few days has moved the Volume Profile Point of Control from 4125 to 4268. What this means in simple terms is that the market floor has been raised.

As I mentioned on Monday, if price is above a long term VPPOC, conditions tend to be bullish. The NQ closed at 4345 on Thursday’s day session, almost 80 points above the VPPOC.

This bodes well for a push past 4355 to the high volume node between 4408 and 4429 as shown on the accompanying chart. If and when we head back down, 4268 will most likely be a critical support level zone.

If you need help with trader discipline in this volatile market visit: http://www.daytradingpsychology.com/increasing-trader-discipline/