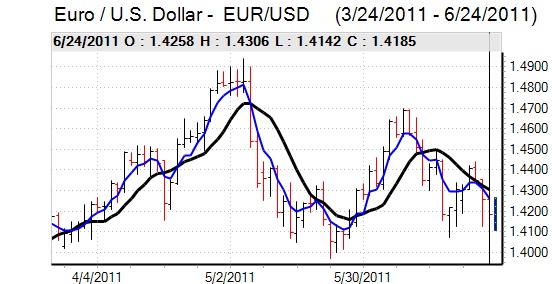

EUR/USD

The Euro initially rallied strongly during the European session on Friday following a better than expected German IFO reading. The business confidence index edged higher to 114.5 for June from 114.2 previously, in contrast to expectations of a small decline and the Euro rallied to a high just above 1.43 against the dollar.

The currency was unable to hold the gains and retreated rapidly back to below 1.42 as a continuation of news releases and rumours unsettled markets. There was a sharp decline in Italian banking-sector shares on reports that some banks would fail the forthcoming Euro-zone stresses tests. There were also reports that more members of the governing PASOK party were considering voting against the Greek austerity package. From a medium-term perspective, there were further fears that the Euro would not survive in its current form even if the Greek austerity package is approved.

Underlying risk appetite also remained very fragile with further tensions surrounding US money-market funds and fresh demand for US Treasuries as defensive dollar demand increased.

The US GDP data was broadly in line with market expectations and there was a 1.9% rise in durable goods orders in a rebound from losses seen the previous month. There were still strong expectations that the Federal Reserve would maintain a very expansionary monetary policy and the Euro’s yield advantage on short-term funds increased to the highest level since the first quarter of 2009.

The latest speculative position data recorded a decline in speculative dollar short positions, but there will still be the possibility of a further adjustment which would underpin the dollar.

The Euro remained on the defensive in Asian trading on Monday and retreated to lows near 1.41 despite assurances from Chinese premier Wen that China would continue to buy European bonds.

Yen

Yen

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The dollar found support just above 80.10 against the yen during Friday and rallied to a high near 80.50 area before rallying further to the 80.80 area in Asian trading on Monday. There were further expectations of strong dollar support in the 80 area which encouraged markets to test the upside for the US currency.

There was also some relief over the US data which helped underpin the US currency, but the dollar still found it difficult to make strong headway as yield support remained weak

Underlying global risk appetite remained weaker on fears over the global economy and this continued to provide some background support for the Japanese currency, especially with further doubts over global equity markets.

Sterling

Sterling found support close to 1.5950 against the dollar in European trading on Friday and rallied sharply to a high near 1.6050 as there was a temporary squeeze on short positions.

Underlying confidence in the UK economy also remained weak with further speculation that interest rates would remain at extremely low levels over the next few months. Markets were also again undermined by speculation over further quantitative easing following the MPC minutes last week.

Bank of England Governor King stated that the direct exposure for UK banks to Greece was limited, but he also warned that there was a high degree of underlying financial risk associated with the Greek debt situation overall.

Sterling therefore has also found it difficult to gain support from the Euro-zone fears given fears that the UK economy and banking sector would also be damaged by any Greek default. In this environment, Sterling failed to hold the gains and tested support below 1.5950 with a decline to fresh 3-month lows near 1.5920 in Asia on Monday.

Swiss franc

The dollar was trapped below 0.84 against the franc during Friday and dipped sharply to lows near 0.8320 before finding fresh support. There was no relief for the Euro as it retreated to test fresh record lows near 1.18.

There were further market fears surrounding the Greek austerity package and default threat. There were also a wider deterioration in underlying risk appetite which continued to trigger defensive demand for the Swiss currency. A key factor for the franc is still that confidence in all other major currencies has been seriously tarnished while franc liquidity is not sufficient to absorb heavy speculative or defensive inflows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

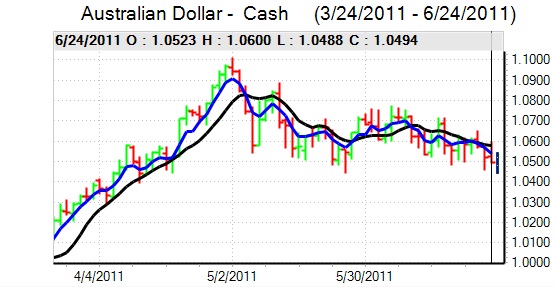

Australian dollar

The Australian dollar rallied during the European session on Friday with a high close to 1.06 against the US dollar, but it was only able to tough this level very briefly before retreating equally sharply to test support near 1.05.

The currency was undermined by a fresh deterioration in risk appetite as fear tended to dominate during the US session and there was a further unwinding of carry trades which hurt the Australian dollar.

As far as the domestic consideration is concerned, there was a further downgrading of Reserve Bank interest rate expectations which had a negative impact on the Australian currency and there were 2-month lows near 1.04 in Asia on Monday.