EUR/USD

The Euro continued to find buying support on dips towards the 1.3850 level during Monday and managed to secure a firmer tone later in the day even though gains were still limited.

There was no further negative news surrounding the Euro-zone economy which helped ease selling pressure and the currency was also over-sold following recent substantial losses. Underlying sentiment towards the region was still negative.

The US manufacturing PMI data was stronger than expected with the key index rising to 58.4 for January from a revised 54.9 the previous month and followed a string of solid survey evidence surrounding manufacturing.

There will continue to be a degree of unease surrounding the non-manufacturing sector and data for the services sector will be watched very closely later in the week.

The latest Federal Reserve loan survey did suggest that credit conditions had stopped tightening which will maintain some optimism that the decline in investment will end.

As risk appetite improved, there was some increase in Euro demand and dollar sentiment was undermined to some extent by fears over the budget situation. The Euro consolidated just above 1.39 on Tuesday and was still finding it difficult to make much progress and dipped lower following the Australian interest rate decision.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below the 90 level against the yen on Monday and posted significant gains in the New York session. The US PMI data increased US yield support which provided a boost to the US currency. There was also a firm rally on Wall Street which boosted risk appetite and curbed defensive demand for the Japanese currency.

Domestically, the latest labour-market data recoded a sharp downturn in overtime earnings which will tend to undermine consumer spending trends and overall confidence in the economy will remain fragile which will curb yen support.

The dollar was able to strengthen towards the 91 level against the yen where resistance to gains increased. The Euro was able to strengthen to above the 126 level against the yen in a correction from recent sharp losses.

Sterling

Sterling came under strong selling pressure early in the European session and dipped to lows near 1.5850 against the dollar within the UK currency undermined by strong Euro demand with the Euro strengthening back above 0.87.

The PMI manufacturing data was significantly stronger than expected with an increase to a 15-year high of 56.7 in the January survey. Sterling initially failed to sustain initial gains following the report, but sentiment did improve slightly.

There will be a high degree of uncertainty ahead of Thursday’s Bank of England interest rate decision. The most likely outcome is that the bank will decide against expanding quantitative easing at this time, but there is the potential for a split vote. Any increase in quantitative easing would tend to put Sterling under heavy selling pressure and this will tend to dampen rally attempts before then.

Sterling did rally back towards 1.5950 on Tuesday with an improvement in global risk appetite helping to stabilise the currency, at least in the very short term.

Swiss franc

The dollar pushed to highs near 1.0650 against the franc on Monday but momentum had clearly stalled and it dipped back towards 1.0550 on Tuesday before finding renewed buying support. The Euro was able to hold above the 1.47 level against the Swiss currency.

Fear of National Bank intervention to prevent franc gains remained an extremely important market influence, especially after the strong speculation of action during Friday.

Selling pressure in the Euro may also have stalled for now, although underlying confidence in the currency remains weak and this will limit any selling pressure on the Swiss franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

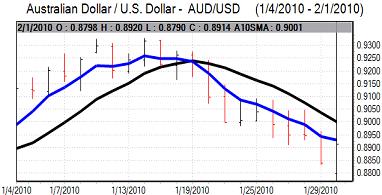

Australian dollar

The Australian dollar found strong buying support just below the 0.88 level against the US dollar on Monday and regained ground in US trading.

Risk appetite improved which was important in boosting demand for the Australian currency, but there will be some unease over a sharp dip in business confidence according to the latest NAB survey.

The Reserve Bank of Australia held interest rates unchanged at 3.75% compared with expectations of a further increase to 4.00% and this triggered a very sharp sell-off in the Australian currency with a decline to lows near 0.88 against the US dollar from highs above 0.8920 immediately ahead of the decision.