By FXEmpire.com

NZD/USD Fundamental Analysis April 17, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

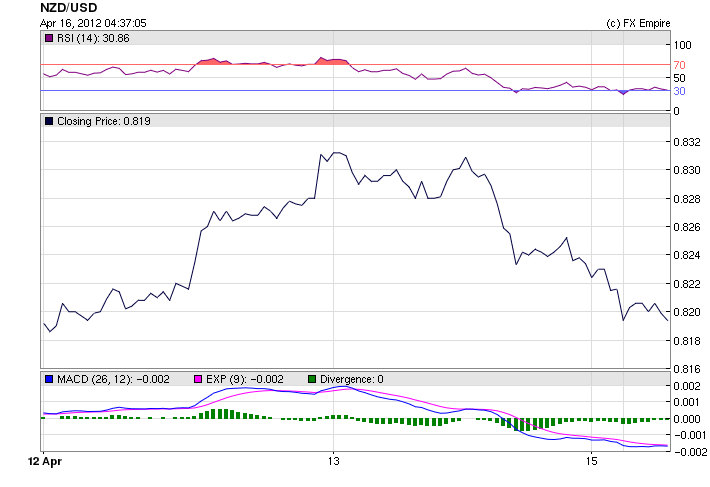

The NZD/USD rose as China doubled the yuan’s trading band, moving toward a more convertible currency and stoking demand for currencies of trading partners.

The kiwi rose to 82.48 US cents from 82.33 cents at the close of trading on Friday. New Zealand’s currency gained to 5.1945 yuan from 5.1788 last week.

Policymakers in China, New Zealand’s second-largest export market, pledged a five-year plan to loosen currency controls as Premier Wen Jiabao targets higher domestic consumption and an enlarged global role for the yuan.

This is the first time China has widened its trading band against the greenback since 2007. That means China will have to reduce its cash and government bond reserves, and is expected to increase buying of trading partner currencies, such as the kiwi and Australian dollars.

Although China prefers a weak currency, it also desires that the yuan should become a major world currency.

The topside cap for the kiwi is just coming down from its close in New York a possible surprised if we were to push into the 83 territory. It is for the Asian markets to decide.

The kiwi rose to 63.08 euro cents from 62.93 cents at the close of trading in New York, to 79.46 Australian cents from 79.15 cents and to 66.69 yen from 66.54 yen.

Economic Data Released on April 13, 2012 actual v. forecast

|

JPY |

Monetary Policy Meeting Minutes |

|||

|

KRW |

South Korean Interest Rate Decision |

3.25% |

3.25% |

3.25% |

|

CNY |

Chinese Fixed Asset Investment (YoY) |

20.9% |

20.8% |

21.5% |

|

CNY |

Chinese GDP (YoY) |

8.1% |

8.3% |

8.9% |

|

CNY |

Chinese Industrial Production (YoY) |

11.9% |

11.5% |

11.4% |

|

CNY |

Chinese Retail Sales (YoY) |

15.2% |

15.0% |

14.7% |

|

EUR |

German CPI (MoM) |

0.3% |

0.3% |

0.3% |

|

EUR |

Finnish CPI (YoY) |

2.90% |

3.10% |

|

|

GBP |

PPI Input (MoM) |

1.9% |

1.2% |

2.5% |

|

BRL |

Brazilian Retail Sales (YoY) |

9.6% |

9.0% |

7.3% |

|

PLN |

Polish CPI (YoY) |

3.9% |

3.9% |

4.3% |

|

USD |

Core CPI (MoM) |

0.2% |

0.2% |

0.1% |

|

USD |

CPI (MoM) |

0.3% |

0.3% |

0.4% |

|

USD |

Michigan Consumer Sentiment Index |

75.7 |

76.2 |

76.2 |

|

USD |

Fed Chairman Bernanke Speaks |

Economic Events scheduled for April 17, 2012 that affect the NZD, AUD, and JPY

05:30 JPY Industrial Production (MoM) -1.2%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

13:30 USD Building Permits 0.71M 0.71M

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts 0.70M 0.70M

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

14:15 USD Industrial Production (MoM) 0.5%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

Government Bond Auctions (this week)

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here