By FXEmpire.com

NZD/USD Fundamental Analysis April 19, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

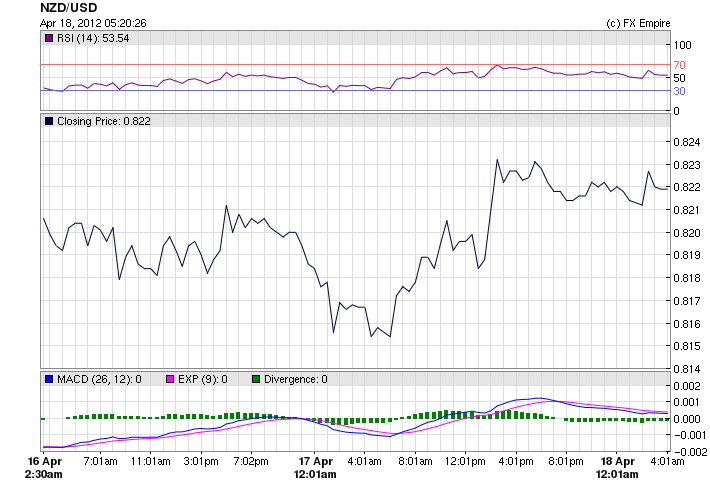

The NZD/USD continued to rise to 0.8216. The strong kiwi is causing export problems for the small country.

New Zealand Prime Minister John Key, who is visiting Indonesia, said on Tuesday the kiwi dollar was high because of weak US and European economies.

He told reporters the government was considering “what we can do to resist a rising exchange rate”.

New Zealand consumer confidence lifted in April, suggesting a pick-up in the local economy as households feel more optimistic about their financial well-being.

The ANZ-Roy Morgan Consumer Confidence index rose to 114.0 in April from 110.2 in March, where a reading above 100 indicates there are more optimists than pessimists.

The Current Conditions index advanced 7 points to 111.6, while the Future Conditions index rose 2 points to 115.7.

Economic Reports for April 17, 2012 actual v. forecast

|

Apr. 17 |

AUD |

Monetary Policy Meeting Minutes |

||

|

JPY |

Industrial Production (MoM) |

-1.6% |

-1.2% |

-1.2% |

|

INR |

Indian Interest Rate Decision |

8.00% |

8.30% |

8.50% |

|

GBP |

Core CPI (YoY) |

2.5% |

2.4% |

2.4% |

|

GBP |

CPI (YoY) |

3.5% |

3.5% |

3.4% |

|

GBP |

CPI (MoM) |

0.3% |

0.3% |

0.6% |

|

EUR |

CPI (YoY) |

2.7% |

2.6% |

2.6% |

|

EUR |

German ZEW Economic Sentiment |

23.4 |

20.0 |

22.3 |

|

EUR |

ZEW Economic Sentiment |

13.1 |

10.7 |

11.0 |

|

EUR |

Core CPI (YoY) |

1.6% |

1.5% |

|

|

USD |

Building Permits |

0.747M |

0.710M |

0.715M |

|

USD |

Housing Starts |

0.654M |

0.705M |

0.694M |

|

Manufacturing Sales (MoM) |

-0.30% |

-1.00% |

-1.30% |

|

|

EUR |

ECB President Draghi Speaks |

|||

|

CAD |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Industrial Production (MoM) |

0.0% |

0.3% |

0.0% |

Economic Events scheduled for April 19, 2012 that affect the NZD, AUD, and JPY

01:30:00 AUD National Australia Bank’s Business Confidence 3

The National Australia Bank Business Confidence is a survey of the current business condition in Australia. It indicates the performance of the overall Australian economy in a short-term view. A positive economic growth anticipates bullish movements for the AUD, whereas a negative growth is seen as bearish.

14:00:00 USD Existing Home Sales (MoM) 4.63M 4.59M

The Existing Home Sales, released by the National Association of Realtorsprovide an estimated value of housing market conditions. As the housing market is considered as a sensitive factor to the US economy, it generates some volatility for the USD. Generally speaking, a high reading is positive for the Dollar, while a low reading is negative.

14:00:00 USD Philadelphia Fed Manufacturing Survey 12.2 12.5

The Philadelphia Fed Survey is a spread index of manufacturing conditions (movements of manufacturing) within the Federal Reserve Bank of Philadelphia. This survey, served as an indicator of manufacturing sector trends, is interrelated with the ISM manufacturing Index (Institute for Supply Management) and the index of industrial production. It is also used as a forecast of The ISM Index. Generally, an above-the-expectations reading is seen as positive for the USD.

23:50:00 JPY Tertiary Industry Index (MoM) 0.80% -1.70%

Tertiary Industry Index released by the Ministry of Economy, Trade and Industry indicates the domestic service sector in Japan such as information and communication, electricity, gas heat and water, services, transport, wholesale and retail trade, finance and insurance ,and welfare. As the Japanese economy relies upon its exports, this event is expected to generate low volatility for the JPY. Generally, a high reading is positive (or bullish) for the JPY, while a low reading is negative (or bearish).

Government Bond Auctions (this week)

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Originally posted here