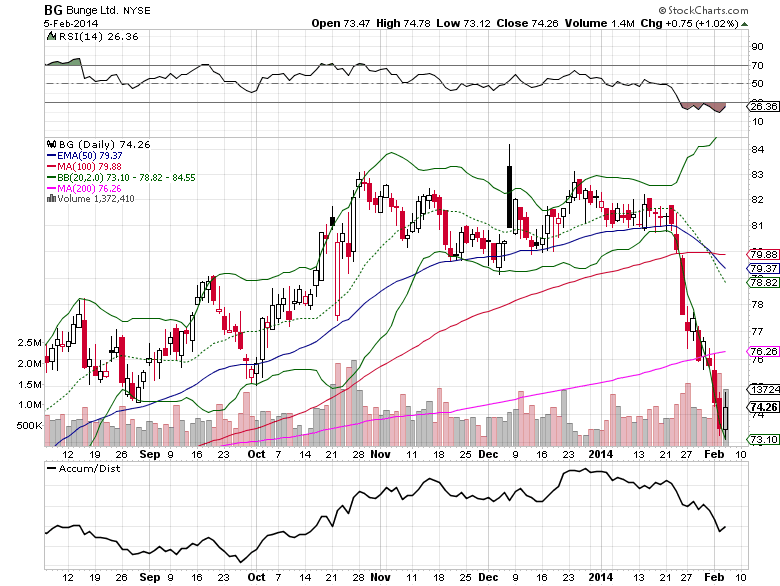

Shares of the global agribusiness and food company, Bunge (BG), have fallen nearly 12% from the highs put in back in December. Bunge trades at a forward P/E ratio of just 9.72 and are expected to grow EPS by 23.40% this year. Revenue is also expected to grow 1.20% to $62.69B in 2014. The median price target of $90 is more than 21% above the current share price. On Thursday, February 13th, Bunge shares go ex-dividend and the company will also release Q4 earnings results.

Unusual Options Activity

3,656 Feb 2014 $75 calls were bought for $1.30 each on Wednesday, February 5th ($475,000 worth of call premium). Call activity was over 17 times the average daily volume. This led to a call to put ratio of better than 7:1. Breakeven for this trade is $76.30 on February 2014 options expiration.

Technical Analysis

The large call buying helped the stock put in a short-term bottom at the $73 level, but it still remains in oversold territory due to the intense selling over the last two weeks. On the weekly chart, shares of Bunge tested a longer-term support line that offers a favorable reward/risk ratio higher than 4:1 for the bulls.

Bunge Options Trade Idea

Buy the Feb 2014 $75 call for $1.55 or better

Stop loss- None

Upside target- $3.00-$4.00