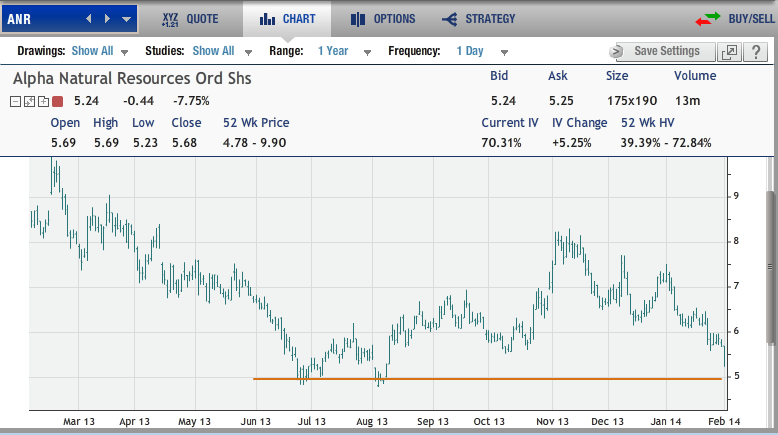

Alpha Natural Resources formed a technical double bottom this summer at the $5 per share base. The ensuing rally has given way to a macro unwinding that is hitting all stocks. Buying at discounted prices is attractive to position for a long term recovery in a single digit stock…. Or to get paid not to buy it at these extreme low levels.

The high implied volatility makes option selling strategies attractive as pure probability trades that utilize time decay acceleration. The February options have a less than 20 days until expiration. The fear and uncertainty can be used to get in another 9% lower for those who are at worst are comfortable holding on to an inexpensive stock to wait for a potential recovery.

Portfolio Strategy

The straightforward price order to buy a stock at a lower level is common if it can be determined where it is comfortable to get in below current prices. Put in the trade at “X” and wait for the dip to enter. Professional money managers have certain points at which they would buy a desirable stock but an option strategy lets them get in at discount or get paid not to.

Selling a cash secured put, has the same mathematical risk profile as a covered call, would assign the stock long at the option strike price. The true entry basis is actually even lower with the subtraction of the premium.

Trade Setup

Sell the ANR February $5 Puts to open at $0.20 or better.

The cash secured put sale would assign long shares at $4.80, near decade lows, if it is put to you costing $480 per option sold. But remember; only sell this put if you want to own the shares at a discount to the current price.

= = =

For more options strategies, visit www.tradingadvantagedaily.com