EUR/USD

The Euro remained under pressure during the European session on Monday and dipped to test support below the 1.40 level for the first time since the middle of March with a low around 1.3965.

The Euro was again undermined by fears surrounding the Euro-zone sovereign risk and credit rating fears as the negative flow of news persisted. Following Standard & Poor’s decision to put Italy’s credit rating on negative watch, there was a similar move on Belgium’s rating by fellow agency Fitch. There has been no government in Belgium for 11 months which has increased fears over the sustainability of debt servicing. Italy announced that budget cuts would be brought forward to help boost market confidence.

Overall confidence in the Euro area will remain very fragile in the short term and there was also weaker than expected economic data as the PMI manufacturing index dipped to a 7-month low, although the services data was more encouraging. There was further expectations of Asian central bank reserve diversification which helped the currency rebound from lows later in the US session, but the US currency was still gaining some safe-haven support as global risk appetite was weaker with the Dow Jones index dipping to a 4-week low.

The dollar was still restrained by expectations that the US economy was losing momentum which would keep interest rates at extremely low levels. Regional Fed President Bullard stated that the Fed was likely to remain in neutral for some time following the end of quantitative easing in June.

The Euro regained some balance during the Asian session on Tuesday with a move back to the 1.4070 area even though confidence remained fragile.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar dipped to session lows below 81.40 against the yen in Europe on Monday as risk appetite continued to deteriorate and equity markets fell sharply. There were reports of institutional dollar buying at lower levels which provided some support to the US currency.

Although risk conditions remained very fragile, there was also some consolidation in risk later in the European session which curbed yen buying. Underlying confidence in the Japanese economy also remains weak with fears that there will be further damage to the export sector which would lessen exporter selling of the currency.

There were no major developments during the Asian session on Tuesday with the dollar blocked in the 82 area as it failed to gain any additional yield support.

Sterling

Sterling remained under pressure against the dollar in European trading on Monday with a test of support close to 1.61. Although there was a general US retreat during the New York session, Sterling failed to benefit and it dipped to 8-week lows around 1.6060 as the Euro found support below the 0.87 level.

There was further unease over the UK banking sector amid reports that lending remained disappointing with rising borrowing costs. There was also a media report that the UK banking sector credit ratings were set to be downgraded by Moody’s which reinforced a pessimistic tone surrounding the domestic financial sector and economy.

Trends in risk appetite remained important and Sterling tended to under-perform when equity markets came under pressure. The Euro-zone developments will be watched closely as any further increase in fear surrounding debt defaults would also increase fears over increased debt write-offs within the UK banking sector. The latest government borrowing data will be watched closely on Tuesday for further evidence on the underlying economy with volatility set to remain high.

Swiss franc

The Euro remained under heavy selling pressure against the franc in Europe on Monday with a retreat to below 1.2350 against the Swiss currency as there were further defensive capital inflows into the franc. There were reports that the National Bank intervened to support the Euro and the Swiss currency retreated back to the 1.2460 area in Asia on Tuesday as long positions were scaled back. The US dollar pushed to a high close to 0.89 before correcting slightly weaker.

The National Bank declined to comment on the intervention rumours, but bank member Jordan did state that the central bank was very worried over the exchange rate and in these circumstances, intervention would not be a surprise.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

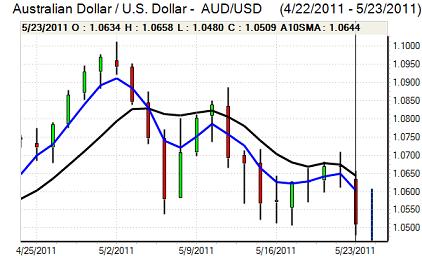

Australian dollar

The Australian dollar continued to fall sharply during the European session on Monday and retreated to below 1.05 against the US currency for the first time in five weeks. Risk appetite remained weaker as equity markets came under pressure.

There were also increased doubts surrounding the global economy as the European and Chinese manufacturing PMI releases were weaker than expected which increased fears over a further downward correction in commodity prices. The Australian dollar did find support below 1.05 and rallied back to the 1.0550 region in Asia on Tuesday.