Rate of Change Can Predict Future Momentum

The rate of change is defined as the speed for which a variable changes in a specified period of time. We look for a change in trend or just an inflection point key in on the rate of change to help determine where momentum may take place and perhaps estimate the trajectory. While it is often difficult to predict a top or bottom with any consistency, from a mathematical perspective we can use the rate of change to identify probable turning points. It is at these moments where significant gains can be had by riding the momentum.

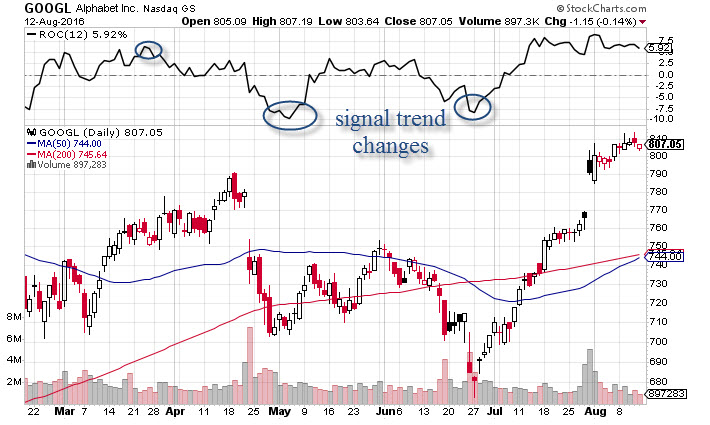

In evaluating stocks, we can use the price rate of change to identify shifts in trajectory and trend. As we see from the chart, the price rate of change often is a leading indicator that tells us the move is about to happen, so get on board quickly. Riding the rate of change to a powerful trend can be quite profitable, but certainly needs to be supplemented with other indicators lining up. For instance, we would like to see volume trends and oscillators moving in alignment with the rate of change, a simple confirmation of the signal. The more indicators that align with the rate of change the more confidence we have in the signal.

We can use the rate of change to evaluate other metrics, including earnings. For the last several quarters the US economy has been in an ‘earnings recession’, with weaker earnings quarter after quarter. There are numerous reasons for this: lower energy prices, a stronger dollar and weak global demand. This has marked reductions in GDP over the past few years. But this current quarter of earnings may have been the trough, as we see the rate of change declining from previous times.

It is certainly a welcomed change. Markets may have already priced in more profit downside, so the worst may indeed be over. Further, if company earnings start to expand then we could see multiple expansion, which could eventually show up in higher GDP down the road. This could be a game changer.

To be sure, there are many different ways to analyze data, but certainly the rate of change offers us good insight as to when a trend change is about to occur. Pay attention to this and other indicators.