EUR/USD

The dollar rallied back to the 1.3460 area in early Europe, but was unable to make much headway. The Euro then secured a renewed advanced with a peak around 1.3520 after a stronger than expected German ZEW figure. The business confidence index strengthened to 53 from 44.5 the previous month which was the highest figure for 12 months which should increase near-term optimism over the economic prospects.

The Euro was unable to sustain the gains and drifted lower over the remainder of the day. There were persistent fears surrounding the Euro-zone structural vulnerabilities and Euro during the day. There was a further widening of yield spreads on Greek bonds over German bunds which maintained the high degree of unease over underlying weaknesses and the risk of escalating tensions in other economies.

The IMF warned that there were still important vulnerabilities surrounding the global banking sector and this is likely to maintain some degree of caution over risk conditions which could also trigger some defensive demand for the dollar over the next few days.

The Euro dipped to a low around 1.3430 against the dollar, but the US currency was unable to extend gains as it was hampered by weakness against the Canadian dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Markets will remain sensitive to official rhetoric on currencies ahead of G7 and IMF meetings at the end of this week. There will also be further speculation that this would be a politically-advantageous time for China to announce a shift in its exchange rate regime. This speculation over a possible Chinese move should underpin the yen to some extent over the next few days.

Asian markets looked to take a more positive attitude towards risk on Tuesday and this dampened yen demand as it remained difficult to secure a decisive trend. The dollar moved back to the 92.60 area in early Europe.

Japanese Finance Minister Kan stated that the central bank and government should act together to push inflation higher and this would also tend to imply a weaker Japanese currency.

There were expectations of higher interest rates in countries such as Australia and Canada and this contributed to a weaker Japanese currency in New York trading with the dollar pushing to a high of 93.35 against the yen.

Sterling

Sterling held firm in early Europe on Monday on rumours that the inflation data was higher than expected and it remained comfortably above 1.5350 against the dollar.

The latest inflation data was stronger than expected with an increase in the headline CPI rate to 3.4% from 3.0% which will provide some initial Sterling support on expectations that the Bank of England may have to raise interest rates sooner than expected and there will certainly be reduced expectations that the bank will expand the quantitative easing.

The inflation data may not provide additional support to Sterling and the principal impact maybe to destabilise monetary expectations which could also act to undermine international confidence in Sterling.

The labour-market data will be watched closely on Wednesday and a robust figure would reinforce speculation over higher interest rates. Sterling was unable to hold above 1.54 against the dollar, but retained a solid tone. The Euro dipped weaker to the 0.8750 area.

Swiss franc

The dollar found support close to 1.06 against the Swiss franc on Tuesday and moved higher during the day with a peak close to 1.0685 in New York trading. The Euro nudged higher against the Swiss currency during the day, although movements were measured with the Euro finding it difficult o sustain gains above the 1.4350 level.

There will be background fears over sovereign debt risks which could provide some underlying support to the Swiss franc. The impact may be limited, especially if there are renewed doubts over the global banking sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

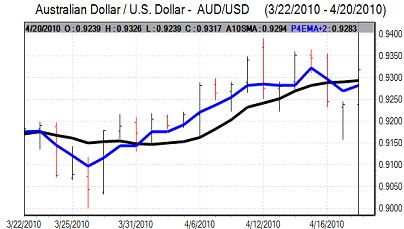

Australian dollar

There was a further Australian dollar advance on Tuesday with gains to just above the 0.93 level against the US dollar. The latest Reserve Bank minutes were relatively hawkish which provided support for the currency on expectations of further interest rate increases while risk appetite stabilised.

There will still be unease over the risk of a Chinese yuan revaluation which will tend to deter Australian buying support and risk appetite is liable to deteriorate again.

The currency edged slightly weaker, but found support close to the 0.93 level in New York trading.