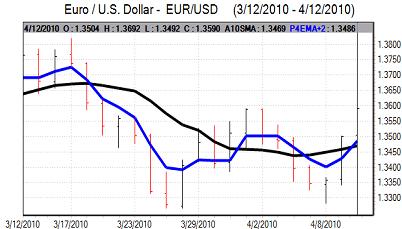

EUR/USD

During Sunday, the EU announced details of the previously-announced support package with Greece able to borrow EUR30bn from Euro-zone countries in the first year of any deal at a rate of 5% compared with market rates near 7%. A further EUR15bn in IMF funds would also be available. The news triggered a further spike higher in the Euro with a three-week high near 1.37 against the dollar as there was a sharp squeeze on short positions with the Euro also securing the largest daily gain since September.

There was also a tightening in yield spreads with the spread on Greek 10-year bonds declining to around 335 basis points over German bunds from a peak over 450 basis points last week.

The planned Greek bond auction will be watched closely on Tuesday to assess underlying demand for bonds and underlying confidence may still prove to be fragile even if there is a further near-term move to curb speculation against the Euro.

The latest US bank earnings reports will start to be released later this week and this may prove important for underlying risk appetite. Weaker than expected earnings would tend to undermine risk appetite and could provide some defensive support for the US dollar.

The US currency proved resilient at lower levels and the Euro retreated to around 1.3590 later in the US session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese banking-sector data was weaker than expected with a 1.8% annual decline in bank lending over the year compared with 1.5% previously which will maintain some degree of unease over the financial sector and economy, although the immediate market impact was limited.

There was evidence of exporter selling when the dollar strengthened and the US currency was also hampered by a decline against European currencies. The Japanese currency was undermined to some extent by generally firm risk appetite and the US currency was able to find support below the 93 level against the yen as the Euro rose to above 127.

The dollar was able to maintain a position above 93 in New York trading while the Euro declined to below 127 against the Japanese currency as there was a slightly more cautious attitude towards risk.

Sterling

The UK currency rallied further against the dollar on Monday, but there was tough resistance towards the 1.55 area while the Euro rallied to 0.8835 against the UK currency. Sterling will continue to be influenced by opinion polls with potential gains if there is increased optimism over a decisive outcome in the May 6 general election. Political trends will continue to be monitored closely over the next few days and the UK currency will find it difficult to gain strong support.

The Greek loan deal is liable to have a mixed impact on Sterling. The deal may curb wider sovereign debt risk which would tend to underpin the UK currency. In contrast, there is also the risk that the underlying fears will now tend to be concentrated more on the UK which would tend to undermine Sterling as markets would be more concerned over the risk of a credit-rating downgrade.

As the dollar stabilised, Sterling retreated to the 1.5370 area in New York as rallies continue to attract selling pressure.

Swiss franc

The dollar dipped to lows near 1.0525 against the franc in Asian trading on Monday before rallying back to the 1.06 area. The Euro pushed to a high just above 1.4450 before drifting back to the 1.4 area during US trading.

The franc may also lose some support if there is a sustained improvement in Euro sentiment following details of the Greek support package, but underlying confidence towards the Euro-zone is liable to remain fragile which should limit Swiss currency losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

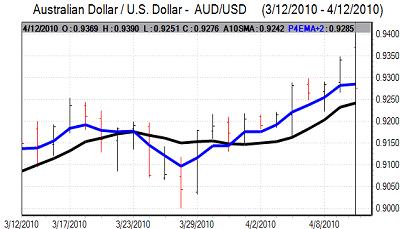

Australian dollar

The Australian dollar pushed sharply higher in early Asian trading with a peak close to the 0.9380 area. The latest home loans data was weaker than expected which will maintain some degree of unease over the growth prospects and the currency was unable to sustain the initial advance with a decline back to 0.9280 in Europe.

There is likely to be some speculation that the Reserve Bank will intervene and limit further gains for the Australian dollar and it was unable to regain the 0.93 level during the day.