By: Scott Redler

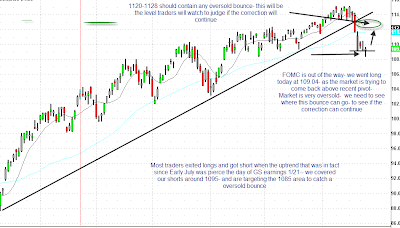

Here is yet another updated chart of the S&P–a lot going on lately! So much so that things might change by the time I post this. BUT, we did get triggered long in the post-Fed trading. Earlier, we had covered our shorts in the 1,095 area on the S&P and we had been patiently awaiting a long trigger in the 1,085 area.

We had RedDog reversals across the board today. We established long positions on the break above $109.04. When you see an oversold market like this, the risk/reward profile changes in favor of the long side. We need to see where this bounce takes us to in order to assess whether to look long or short in the near future. Watch the 1,120-1,128 area closely to see if it can contain this attempted bounce. If we cannot reclaim that zone, then it will once again be time establish short positions.

We had RedDog reversals across the board today. We established long positions on the break above $109.04. When you see an oversold market like this, the risk/reward profile changes in favor of the long side. We need to see where this bounce takes us to in order to assess whether to look long or short in the near future. Watch the 1,120-1,128 area closely to see if it can contain this attempted bounce. If we cannot reclaim that zone, then it will once again be time establish short positions.