Just a reminder, these charts are posted as examples of the trades on the nightly COT Signals email. These trades will help illustrate the mechanics that go into creating the nightly email.

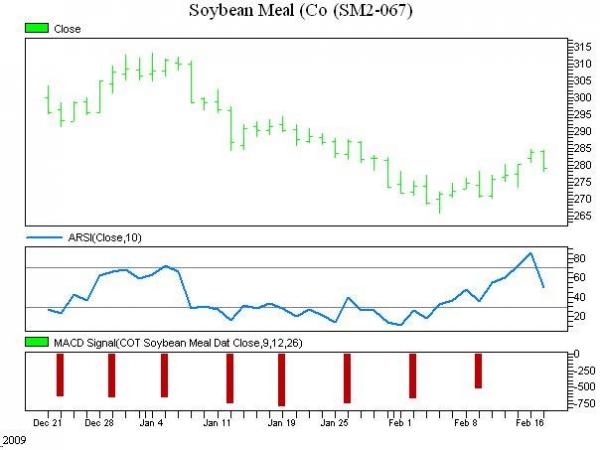

Soybean Meal appears to be setting up for a short term pullback. The rally off of the 265 lows has stalled at the first possible resistance, now at 284.5. Furthermore, according to our indicators, the market has used a lot of energy to generate this rally.

Considering that Soybean Meal is one of only two grain markets with negative commercial momentum, I’m willing to bet that they know more about the inner workings of this market than I do.

Finally, March Soybean Meal is near the end of its contract cycle. This means that open interest is rolling over from the March contract to the May contract. In the context of negative commercial momentum, I expect this to mean fewer physical deliveries and thus, lower prices into expiration.

We are selling March Soybean Meal and placing a protective buy stop at the recent high of 284.5. This is most likely, a short term trade with a profit objective somewhere around the 270 area.

Please call with any questions.

Andy Waldock

866-990-0777