[Editor’s note: For energy market newbies, the crack spread is simply the spread between crude oil and one of its products, in this case RBOB gasoline futures traded on the Nymex.]

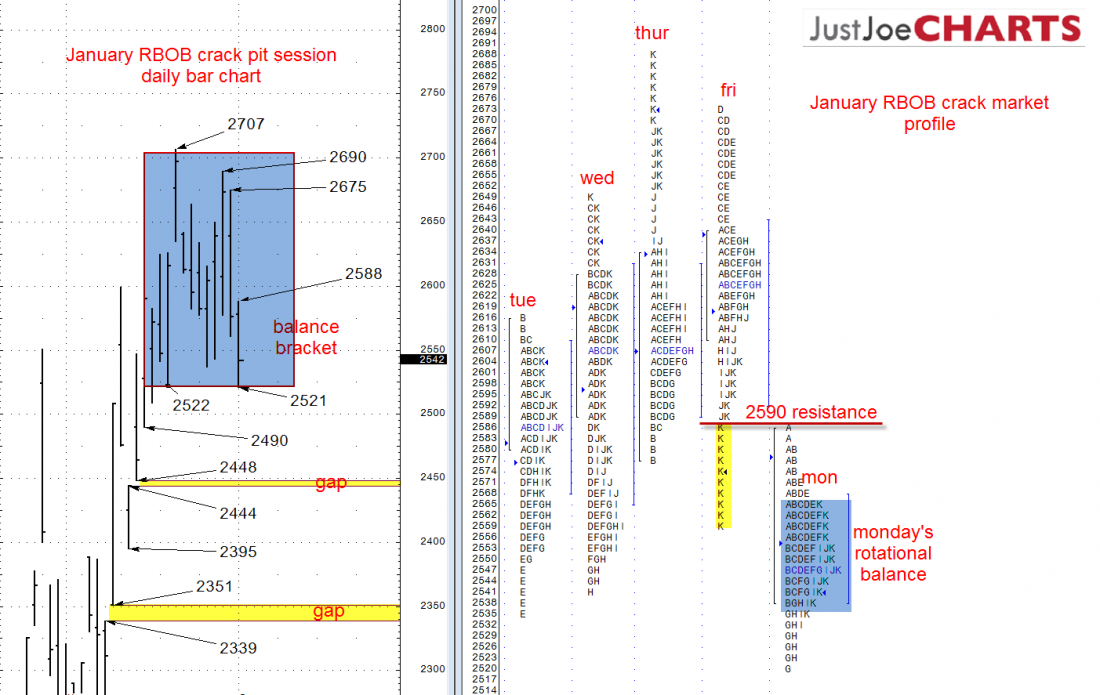

Over the past two weeks, the RBOB crack spread has been trading withinin a relatively tight 2522 to 2707 balance bracket. On Monday, the market traded 1 tick below that 2522 balance bracket low, but was quickly rejected, before rotating within a tight range for the remainder of the day.

GO/NO GO LEVEL

The term “GO/NO GO LEVEL” was coined by my mentor, Jim Dalton. Jim uses that term when a market reaches an important reference where the odds of a significant move, in either direction, are high. In this case, the lower extreme of the balance bracket is the the GO/NO GO level. When the market tests an extreme of a balance bracket the 2 most likley scenarios are 1) gain acceptance outside the balance bracket and accelerate or 2) Trade outside the the balance bracket and get rejected, which would likely begin a rotation to the opposite end of the balance bracket.

DOWNSIDE SCENARIO

If the market gaind acceptance below the 2522 balance bracket low, it may test the 2444 to 2448 gap below.

UPSIDE SCENARIO

If the market gains acceptance above the 2590 resistance level, it may begin a rotation back up near the 2707 top of the balance bracket.

Be patient entering a trade as most times it is better to be a little late entering a trade than a little early.

= = =

Read more trading ideas in our daily Markets section.