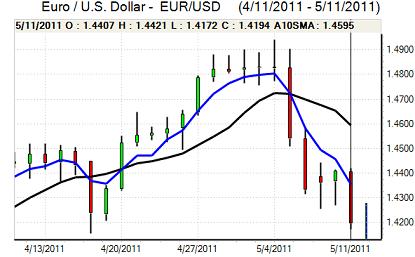

EUR/USD

The Euro stalled close to 1.44 against the dollar in European trading on Wednesday and was subjected to renewed selling pressure during the US session. The currency weakened to three-week lows below 1.42 with the fundamental and technical outlook deteriorating as the dollar looked to break above previous trend-line support.

There was renewed selling pressure on commodities during New York trading with oil prices retreating sharply while there was renewed selling pressure on metals prices. These declines triggered fresh defensive demand for the US dollar as there was also pressure for a reduction in short dollar positions

The US trade deficit was higher than expected at US$48.2bn for March despite a strong export performance which will maintain unease over medium-term dollar valuations. Regional Fed President Kocherlakota maintained his preference for a 0.50% increase in Fed funds interest rates by the end of 2011 and markets will continue to monitor Fed comments closely ahead of the June FOMC meeting.

There were persistent fears surrounding the Euro-zone structural outlook which undermined the currency. There were further uncertainties surrounding the Greek debt situation and there was also a delay surrounding the Finnish parliamentary vote on the Portuguese debt bailout programme which will increase fears over rejection.

The German political situation will need to be watched very closely, especially with Chancellor Merkel stating that Greek progress on fiscal consolidation would need to be seen before further measures could be taken. The Euro found support below 1.42 before correcting slightly higher in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 80.60 area against the yen on Wednesday and re-tested resistance in the 81.20 area with the dollar holding firm, but unable to make strong headway, especially with no improvement in yield support.

Both currencies gained support from a fresh deterioration in risk appetite and a move into more defensive currencies as commodities came under fresh selling pressure. The yen will continue to gain support from pressure to close carry trades funded through the Japanese currency.

The latest Japanese current account data recorded a sharp decline in the surplus to JPY240bn for March from JPY723bn previously as exports declined. The underlying balance of payments position will remain weaker in the near term and this will tend to undermine the yen.

Sterling

Sterling edged weaker against the dollar ahead of the Bank of England inflation report on Wednesday in subdued conditions. As expected, GDP growth forecasts were downgraded in the quarterly report and the bank also warned over the outlook for consumer spending as real incomes continued to decline. The bank, also raised its inflation forecasts with the headline rate set to rise to over 5.0% as energy costs rise.

In his press conference following the report, Bank Governor King warned that interest rates would eventually need to rise and the inflation report was consistent with rates rising slightly in the third quarter of 2011. King, however, also warned that weakness within the banking sector would lessen the scope for higher rates and there were very important concerns surrounding the economy.

The report provided immediate support for Sterling on a revision to interest rate expectations, but the currency will find it more difficult to gain sustained support given the downbeat assessment. From a peak above 1.65 against the dollar, Sterling retreated to lows around 1.6320 on a fresh bout of US currency strength, while the UK pushed to a 7-week high near 0.8675 against the weaker Euro.

Swiss franc

The dollar found support below 0.88 against the Swiss franc on Wednesday and strengthened to a high near 0.8890 late in the US session. The franc found it more difficult to advance against the Euro despite the spike in risk aversion with the Euro finding support below the 1.26 level. Franc demand was still undermined to some extent by reduced expectations of a National Bank interest rate increase.

The franc will still gain some defensive support from any sustained deterioration in risk appetite and stresses surrounding the Euro-zone will also underpin the franc as sovereign-debt fears continue with potential capital flight into the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

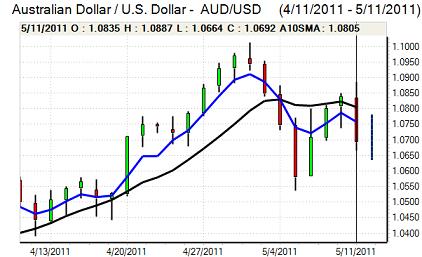

Australian dollar

The Australian dollar hit selling pressure above 1.0850 against the US currency during Wednesday and dipped sharply during the US session with a retreat to test support below 1.07. The Australian currency was undermined by a renewed slide in global commodity prices and deterioration in risk appetite.

The latest labour-market data was much weaker than expected with an employment decline of over 22,000 for April and there was a particularly sharp decline in full-time jobs. The data will certainly lessen any expectations of a Reserve Bank policy tightening. In response, the Australian dollar fell sharply to lows below 1.06 before a partial recovery later in the Asian session.