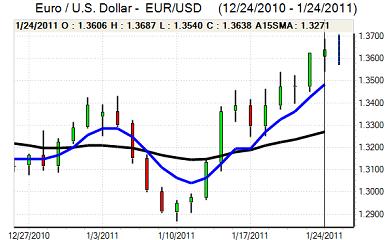

EUR/USD

The Euro retreated to lows just below 1.3550 against the dollar during European trading on Monday, but there was again strong buying support on dips and it advanced to a fresh two-month high around 1.3685 during the US session with further evidence of sovereign buying again an important supportive factor.

The Euro-zone PMI data was mixed as weaker than expected data for the manufacturing sector was offset by a firmer reading in the services sector. As in previous sessions, fears surrounding the Euro-zone debt markets and solvency were kept at bay and investors were also optimistic over strong demand at this week’s EFSF bond auction. With optimism over the economy, German yields retained a sizeable premium over equivalent US bonds which helped underpin the Euro with some further speculation that the ECB would consider raising interest rates.

There was some unease over the implications of an early Irish election and some renewed speculation that Belgium’s credit rating could be downgraded, but overall market stresses remained contained and the dollar trade-weighted index weakened to a 10-week low.

There was a general improvement in risk appetite during the session which curbed any defensive demand for the US currency. Attention will focus on the Federal Reserve interest rate decision due on Wednesday. There will need to be a shift in the Fed’s rhetoric and hints that the quantitative easing programme could be amended for the dollar to gain strong support with the Euro holding above 1.36 on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar pushed to a high of 82.90 against the Japanese currency on Monday, but was unable to make a serious attack on the 83 level and was subjected to renewed selling pressure during the US session with a low close to 82.30.

The yen rallied even as general risk appetite improved, but the Japanese currency will still tend to lose ground if there is sustained optimism towards the global economy.

As expected, the Bank of Japan left interest rates on hold in the 0.00 – 0.10% range and the central bank also left its economic outlook unchanged. The bank overall suggested that it was slightly more optimistic over the economic outlook, but it will maintain an extremely loose monetary policy which will continue to cap any strong yen demand.

Sterling

Sterling retreated to lows just below 1.5920 against the dollar on Monday, but then rallied to re-test the 1.60 area again during US trading. The move was led by underlying dollar vulnerability with the UK currency retreating to a 3-week low at 0.8550 against the Euro.

There was further market and media discussion surrounding the outlook for UK interest rates. MPC member Sentence, who has consistently called for a tighter monetary policy over the past few months, again called for interest rates to be raised quickly in order to combat inflation.

There were still doubts whether the economy would be strong enough to withstand higher borrowing costs and the latest UK economic data will be watched very closely on Tuesday. A stronger than expected GDP outcome would make it easier for the bank to justify higher interest rates, although survey evidence is likely to be crucial for the actual decision. The MPC minutes will also be extremely important for Sterling on Wednesday.

Swiss franc

The Euro was unable to hold above 1.30 against the franc during Monday and retreated to a low below 1.2950. A more resilient Swiss tone was another negative factor for the US currency and it retreated to a trough around 0.9470, the lowest level since the first week of January.

Given that there was increased optimism surrounding the Euro-zone outlook, the franc’s performance was slightly surprising any may indicate that pressure to cover existing short Euro positions has now faded. It may also suggest that the Euro will find it difficult to secure further wider buying support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on retreats to the 0.9860 area against the US dollar on Monday and, after a break above 0.9920, it accelerated sharply to a peak just above parity. The currency drew support from a general improvement in risk appetite as US equity markets rallied.

Domestically, the fourth-quarter inflation data was significantly weaker than expected with a headline CPI increase of 0.4% compared with expectations of a 0.7% gain while the underlying increase was held to 0.3%. Although prices are expected to spike higher this quarter due to flood damage, there were reduced expectations of any further Reserve Bank tightening which pushed the Australian dollar to lows just above 0.9920.