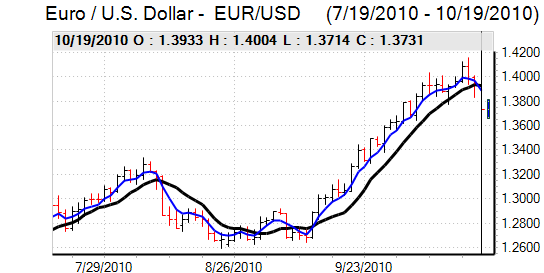

EUR/USD

Risk appetite was generally weaker in European trading on Tuesday and this triggered a more defensive tone for the Euro with the currency unable to make a fresh challenge on the 1.40 level. ECB President Trichet stated that not all EU financial statistics are reliable which may increase unease over the structural vulnerabilities.

The US housing starts data was slightly stronger than expected with an annual rate of 0.61mn for September, unchanged from the upwardly-revised August data. Any positive impact on confidence towards the US economy was offset by a decline in permits to a 0.54mn annual rate, the lowest figure since March.

With permits the more forward-looking indicator, there were fresh doubts over the economy. Regional Fed President Lockhart reiterated that he was leaning towards pushing for further quantitative easing and Governor Dudley was also very cautious over the economic outlook. Markets, overall, will continue to expect fresh action by the Fed.

Risk appetite deteriorated following the Chinese decision to increase interest rates and there was a sharp weakening in commodity-related and emerging-market currencies. Given that the bulk of flows into these currencies had been through US dollar selling, weakness in emerging currencies had a positive impact on the US dollar and the Euro weakened to near 1.38 in New York as the US unit advanced strongly against the commodity currencies.

There was a further covering of short US positions following reports that major institutions were looking for early re-payment of certain Bank of America mortgage-related bonds. The Euro remained vulnerable to a further correction and tested support levels below 1.3750.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

US Treasury Secretary Geithner stated that nations could not devalue their way to prosperity and this provided some immediate dollar support against the Euro and yen with some reduction in immediate speculation that the US Administration would push for an aggressive policy of pushing the dollar weaker.

There was also reservations over aggressive policy moves ahead of the G20 meetings at the end of this week with investors wary that there could be efforts to contain currencies within pre-planned ranges and deter speculative capital flows.

The dollar continued to find support close to the 81 area against the yen and rallied to a high near 81.50 as the Bank of Japan was also generally downbeat over the economic prospects. The yen gained some defensive support on the crosses as risk appetite deteriorated, but the US currency pushed to a peak near 81.90. The dollar was unable to sustain the gains and retreated back to the 81.50 area with the yen robust on the crosses.

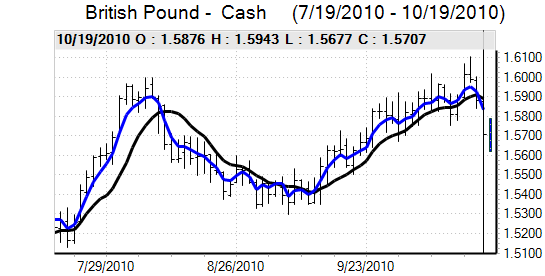

Sterling

The UK currency maintained weaker bias on Tuesday with a deterioration in global risk conditions having some negative impact on sentiment.

There will be further expectations of a slowdown in the economy and markets were unwilling to maintain long positions ahead of event risk on Wednesday. Sterling will be vulnerable to selling pressure if there is a more dovish stance in the Bank of England MPC minutes, especially if there were any votes for additional easing at the October meeting.

Consumer confidence is also liable to deteriorate following the announcement of detailed government-spending reductions on Wednesday. Bank of England Governor King avoided any major comments on monetary policy in comments on Tuesday.

Sterling tested support below 1.57 against the dollar, but did find support weaker than 0.88 against the Euro as volatility intensified.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Swiss franc

The dollar found support below 0.96 against the franc on Tuesday and strengthened to a high near 0.9750 as there was a wider setback for continental European currencies. The Euro retreated to the 1.3320 area against the Swiss currency in choppy trading conditions.

Risk appetite is likely to be generally fragile in the short term and any sustained reduction in capital flows into emerging-market currencies would tend to provide underlying defensive support for the Swiss currency. Gains could accelerate if there are any renewed tensions surrounding the Eastern European mortgage sector.

Australian dollar

The Reserve Bank of Australia minutes were slightly tougher than expected with comments that the decision between holding rates and increasing rates were finely balanced which will increase speculation that the bank could decide on a rate increase at the November meeting. The currency was unable to sustain initial gains and retreated back to the 0.9850 area.

There were further sharp losses following the Chinese decision to increase interest rates and there were lows below 0.970 as equity markets also weakened with the Australian currency subjected to heavy profit taking.