When looking for new opportunities of investment, we search for different industries that are doing well and also sectors that are new and upcoming. One of these growing industries is the robotics and automation sector

GROWING INDUSTRY

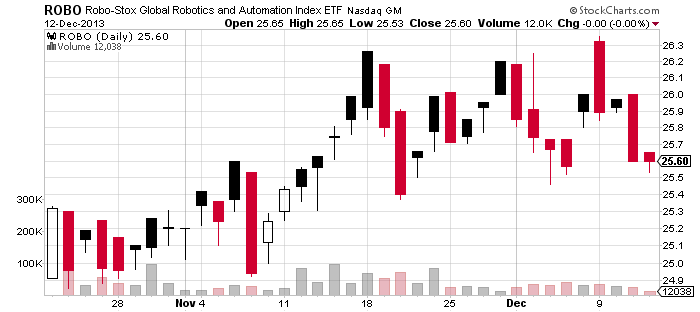

The chance to get into this field has come recently since the Robo-Stox Glbl Robotics & Automation ETF (ROBO) was recently launched in late October. This instrument seeks to provide investment results that correspond generally to the price and yield performance of the Robo-Stox Global Robotics and Automation Index.

According to recent data, ROBO has already over $25 million in assets under management as of the end of November.

As the exchange traded products industry continues to expand its presence in many sectors of the global marketplace, ROBO offers investors an opportunity to capitalize on the performance of those robotic and automation companies that carry the most promising growth potential.

The rapid increase of funds under its management is evidence of the great interest from investors in the worldwide robotics and automation sector.

ETF COMPONENTS

Some of the main holdings of this ETF are highly liquid such as AeroVironment (AVAV), Deere & Co (DE), Intuitive Surgical (ISRG) and 3D Systems (DDD) amongst many others.

The fund also invests in technology old-timers such as Toshiba Machine Co., Topcon Corporation, Mitsubishi Electric and Siemens AG, giving investors the reliability of experienced companies in this industry.

Although the ETF is very new and we have to wait for some time to pass to see how the combination of these various companies gel under one single umbrella, the truth is that it gives us the chance to enter the wide automation sector with one single shot.

===