INTRODUCTION—

Sugar prices especially, have rallied in recent weeks, partly on the world supply deficit but also due to what is going on right now in India with their monsoon. Other commodities such as oilseeds and cotton may be affected somewhat as the monsoon stays erractic.

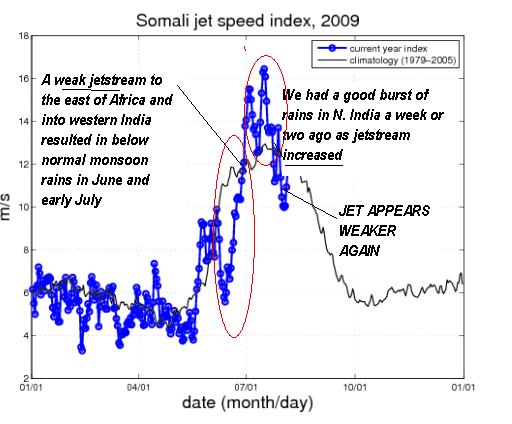

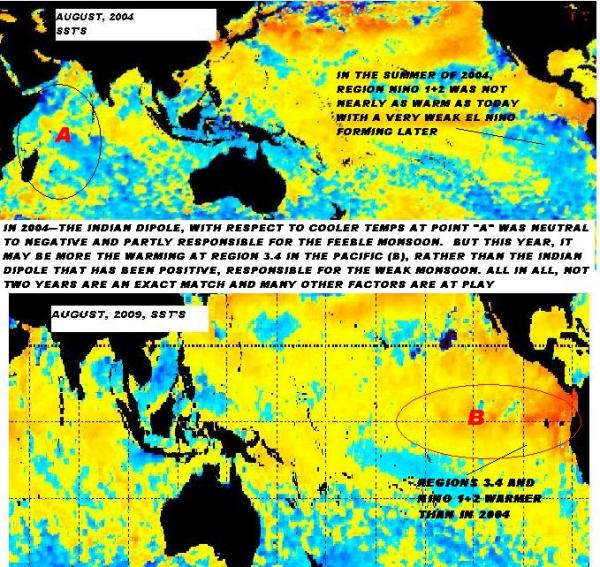

There are a million different climatological criteria we can look at to forecast the Indian Monsoon .Everything from SST’s in the ocean and seas around India, to whether El Nino has formed, as well as looking at the Somali Jetstream coming off Africa, the AO, NAO and other indicies, and of course just looking at the models. All in all, teleconnections are very mixed right now with the Indian Dipole and SST’s around India suggesting more normalized rainfall, but a weak El Nino and slightly +AO and NAO index and other teleconnections maintaining an erratic monsoon. We are not calling for a major disaster, because El Nino is not full blown and if this (El Nino) was coupled with a negative Indian Dipole, major crop losses would be the rule. Nevertheless, we have not changed our feeling from two months ago in our June 7th El Nino report for some crops having at least slightly below normal yields.

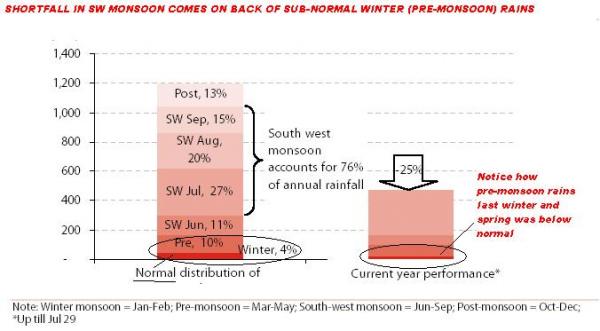

Many people have wondered why just a 10% reduction in the monsoon makes a big difference in yields of certain crops and the GDP? Part of the reason is, is that India depends too on irrigation for about 45% of their crop needs. A dry end of the year last year and during the winter have reduced irrigation supplies, so they are more dependent this year, than in most years for above normal rains. Also, due to higher evaotranspiration and other factors discussed a few weeks ago, a 10% reduction in rainfall is similar to maybe 20-30% in rainfall in some countries closer to the coast. In other words, in many countries, a 20-30% reduction of rainfall is a fairly big deal.

Below are some discussions of the India situation

Cotton areas have benefited from recent rains but more erractic monsoon in Tamil Nadu and possibly Gujarat could result in some problems.

Sugar cane regions–about 50% of the area under stress (no change from recent comments)

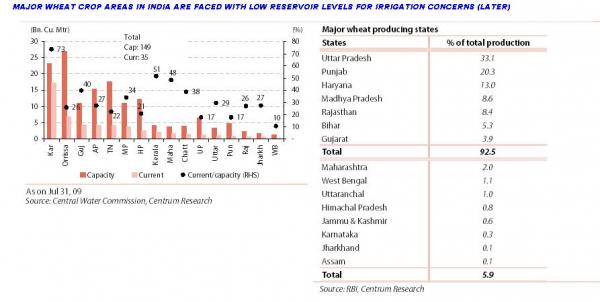

Wheat regions –Not a factor yet but if rainfall does not pick up by late summer, some concerns over below-normal irrigation supplies

While U.S. soybean weather is bearish, key oilseed areas in India have to be watched for some possible below normal yields.

A LOOK AT THE INDIAN MONSOON FORECAST FOR THE MONTH OF AUGUST

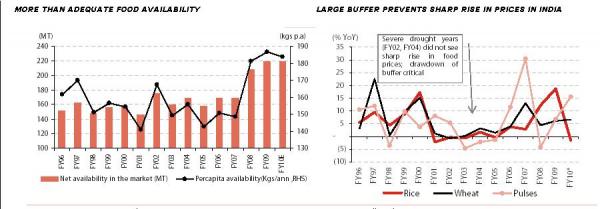

For some commodities, such as wheat, rice and pulses, price rise impact can be managed: Record food grain production over the past few years and large procurements have resulted in a steep 39% rise in per capita availability of cereals during FY05-09. Assuming 1.5% population growth, 10% fall in food grain production and 11mt release from buffer stock, overall per capita availability will still be significantly higher than FY05-07. However, one of the biggest ag commodity concerns, not shown here is sugar. We have mentioned the last few weeks our concerns that India may have to step up import needs for sugar this year due to the likelhood of another shortfall in their crop. India is a big exporter of cotton and we still feel that yields may fall slightly below trendline this year, though planted acreage is suppose to be way up and timely rains 2 weeks ago probably prevented a sharp decline in early planted acreage estimates.

Teleconnections, which equate more medium term climatological occurrences with weather events, sometimes thousands of miles away, are often used by meteorologists. Above, the AO, NP and NAO index are all positive suggesting an erratic monsoon in the areas in blue. The AO index has to do with what is going on over the N. Pole, NAO index over Greenland and NP index over the North Pacific.

Without going into too much detail, even for India, there is a slight correlation for below normal August rains for Gujarat (cotton) and a few areas of Madhya Pradesh (Sugar). Some key oilseed regions may also see no better than trend line yields and possibly below normal.

LOOK AT THE INDIA SITUATION, ITS AFFECT ON CROPS, THEIR GDP, ETC.

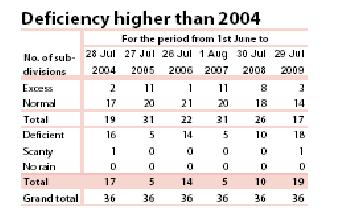

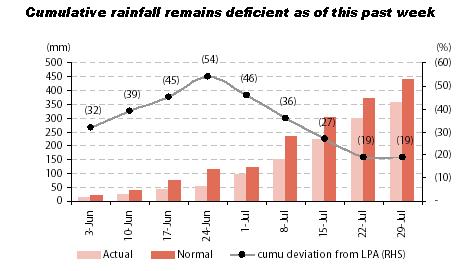

I showed above how the present Indian Monsoon is the weakest since 2004. You can see that as of July

29th, it was reported that 19 sub-divsions in India had below-normal rainfall, compared to the previous

low mark of 17 sub-divisions in 2004.

2004 was a weak El Nino year that continued through the winter.

Indian officials have now said the probability of full-year deficiency in rainfall has increased: With the south-west (SW) monsoon still 19% below normal, the possibility of full-year shortfall has increased. They now estimate 10% deficiency. The rains were deficient last year (2009), even during the pre-SW monsoon period. This has had a more immediate impact on sugar prices, in my opinion due to the very tight stocks, while cotton and wheat have more adequate world supplies and would not be impacted until later in the year.

Wheat prices continue to stuggle over large global supplies. Even with some earlier concerns in Canada from dry weather and now it’s too cool, plus drought in parts of the spring wheat areas of Russia and some concerns

still in Argentina, Informa raised their world wheat production estimates in other countries. Now, we will have to monitor, of course, Argentina and Australia’s weather this fall, as well as in India. If two or three of these countries have problems, this could be important to the wheat market later. We will take a look at possible fall rainfall and temp patterns next week based on certain teleconnections for other parts of the world.

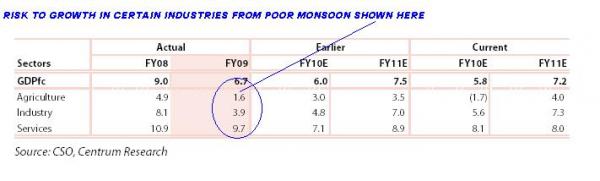

Risks to growth: A decline in food grain production would imply agriculture GDP decline of 1.75% in FY10E vs.

earlier estimates by India officials of of 3% growth. This 125bp decline could offset the positive impact from improving financial conditions, external demand and fiscal spending. They now anticipate 20-30bp downside risk to our GDP growth projections.

For some commodities, such as wheat, rice and pulses, price rise impact can be managed: Record food grain production over the past few years and large procurements have resulted in a steep 39% rise in per capita availability of cereals during FY05-09. Assuming 1.5% population growth, 10% fall in food grain production and 11mt release from buffer stock, overall per capita availability will still be significantly higher than FY05-07. However, one of the biggest ag commodity concerns, not shown here, is sugar. We have mentioned in the last few weeks our concerns that India may have to step up import needs for sugar this year due to the likelhood of another shortfall in their crop. India is a big exporter of cotton and we still feel that yields may fall slightly below trend line this year, though planted acreage is suppose to be way up and timely rains 2 weeks ago probably prevented a sharp decline in early planted acreage estimates.