ROEMER…TUESDAY-9-1-09

SUGAR………..Prices continue to soar on worries over the Indian monsoon, even though good rains have fallen

in key areas in the last 3-4 days. However, Tamil Nadu, which produces 15% of the crop is getting dry again, the fact that weekly rainfall as of last Thursday was still 5% below trend line in India as a whole, and as much as 15% below trend in sugar cane areas, is still creating panic. Also, I mentioned a few weeks ago my concern that

Ukraine is too dry in the CIS region where some sugar beet loss has occurred. Below you will see totals since April for Ukraine. The yellow region is last year, gray the 5 year average, and red shows current rainfall departures below normal over some key regions.

In Parana and S. Sao Paulo, rains of over 4-5 inches last week has resulted in some harvest delays. Although

some drier weather has occurred again, there is more in the forecast that may result in some harvest delays.

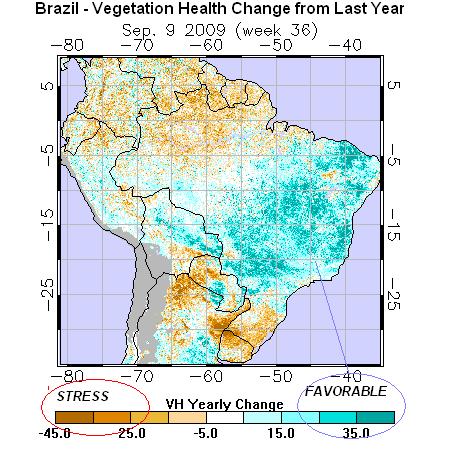

In a study I did yesterday about N. Brazil weather during September-October (mainly for coffee), based on

the QBO index being negative, warming at region Nino 3.1 to 3.4 in the equatorial Pacific and other things

I discussed, it is possible that an overall wet pattern may develop sometime this fall. Hence, this continues to all be an amazing bullish impetus in prices, with sugar now at 29 year highs.

I mentioned 3-5 weeks ago that I was friendly sugar, but that occasional profit taking might occur, due to upcoming

rain events in India. This week coming up, is really the biggest rain events of the season for key areas, except

in the south. Finally, in a sugar report I wrote two weeks ago, I mentioned that Cuba’s rainfall has been too light and

some yield loss may also be occurring. Sugar is probably the #1 weather market right now and has been

for months due to the tight supplies and the weakest monsoon in India since 1972.

COCOA

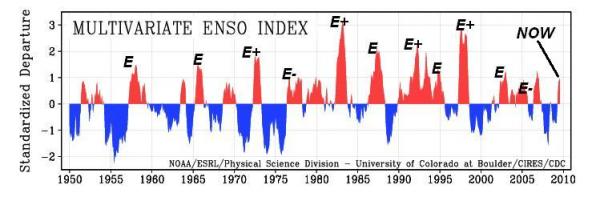

In the next day or two (not today), I want to take a closer look at the 1972-73 El Nino event, sea surface temps, etc. Why? India has had the driest summer since 1972 and I want to look and see if there are any similarities with W. African cocoa. This is a bit surprising, given that El Nino is not all that strong and SST’s around India are favorable for summer rains. Hence, other climatological reasons, with respect to the QBO (stratospheric wind changes), etc. are likely the reason.

Also, I want to look at 1994. This was the last real severe harmattan wind in W. Africa, although we had some problems in the late winter, early spring in 2008. So, I want to see what, if any, similarities there might or might not be.

El Nino is really weak and alot of people are all excited about a strong Harmattan this winter. So, I also want to go back and look at historical winter tendencies of the SOI index and any trends that I might be able to make, as the sun’s angle sets further south into the Southern Hemisphere—sometime, this could influence SST’s, etc.

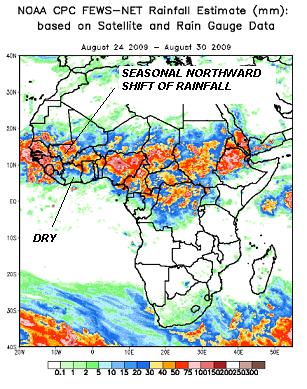

For now, drier weather over the last month and a half in the Ivory Coast and last month in Ghana, should “normally”

reduce the risk of disease losses to the main crop. However, I am becoming a little concerned that maybe it

has been too dry in a few areas. Although we are entering the drier season, normal late September and October rains

are still necessary to avoid some loss in yield. The recent dry weather in W. Africa is the driest since 2005, which

was not a weak El Nino year. Back then, rainfall increased by late September and October. Will it this year? This may be important later and I will take a closer look at this mid-late this week.